Developing…

It doesn’t look like there’s much in Yellen’s remarks regarding whether or to what extent the Fed would step in to address risks to financial stability.

Further, I’m not seeing a whole lot here that has the potential to alter anyone’s views on balance sheet timing or the trajectory of policy normalization, but maybe that’s just my read.

So far, FX is reading it as dovish – or so it seems from the reaction.

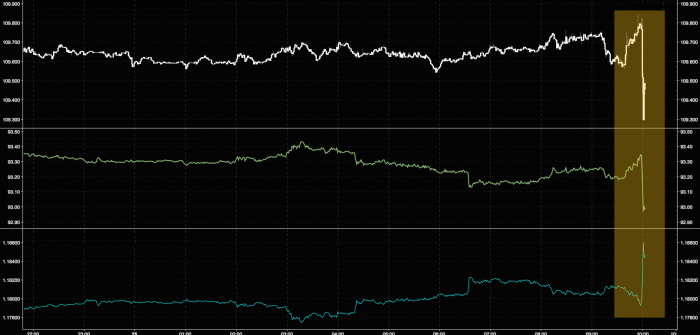

Here’s USD/JPY, DXY, and EUR/USD in descending order:

And here are the highlights from Yellen’s speech in Jackson Hole via Bloomberg:

- “All-too-familiar risks of excessive optimism, leverage, and maturity transformation” will re-emerge “sooner or later” in new ways that require policy responses, given technology, regulation and evolution of financial system

- Market-based measures may not reflect true risks; supervisory metrics “are not perfect, either”

- Credit default swaps for large banks suggest market participants are assigning low odds to distress of a large U.S. bank

- Market-based assessments of the loss-absorbing capacity of big U.S. banks have moved up, and measures of equity now in range of book estimates

- Healthy condition of the market is apparent in low bid-ask spreads, large volume of corporate-bond issuance

- Even so, “liquidity conditions are clearly evolving”; some regulations “may be affecting market liquidity somewhat”; may be benefits to simplifying parts of Volcker rule

- Credit may be less available to some borrowers, even if it’s “not readily apparent” that there are material adverse effects of regulation on broad lending measures

- Credit appears broadly available to small businesses with solid histories

Leave A Comment