A thought…

Video length: 00:04:05

Citi summed the last few days up well… and ominously…

“Bear markets open on the highs and close on the lows. This is particularly the case when derivative products need to rebalance in a relatively narrow window near the end of the day“

And what happened again?

And its happening across all the major equity indices…

Nasdaq just suffered a 4-day losing streak – its longest since Nov 2016.

Pretty clear what the machines had in mind today – run The Dow up to hunt the pre-FOMC stops… but there was no momo…

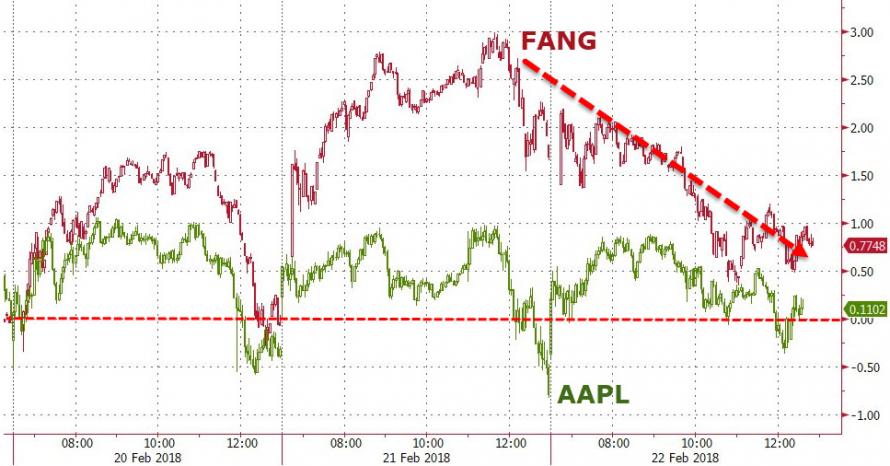

FANG stocks faded today and AAPL is unch on the week…

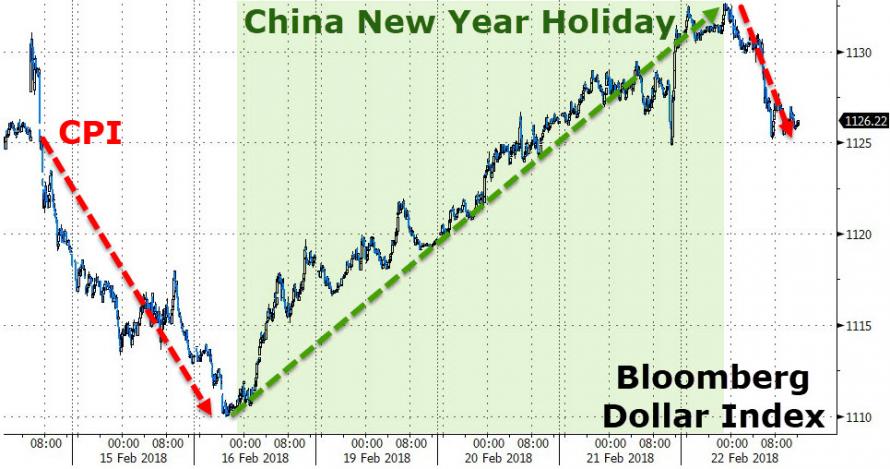

China is back from its New Year celebration (China stocks gained – playing catch up), and The Dollar dropped for the first since they left…

Zooming in, it’s clear the machines were testing yesterday’s post-FOMC Minutes plunge lows…

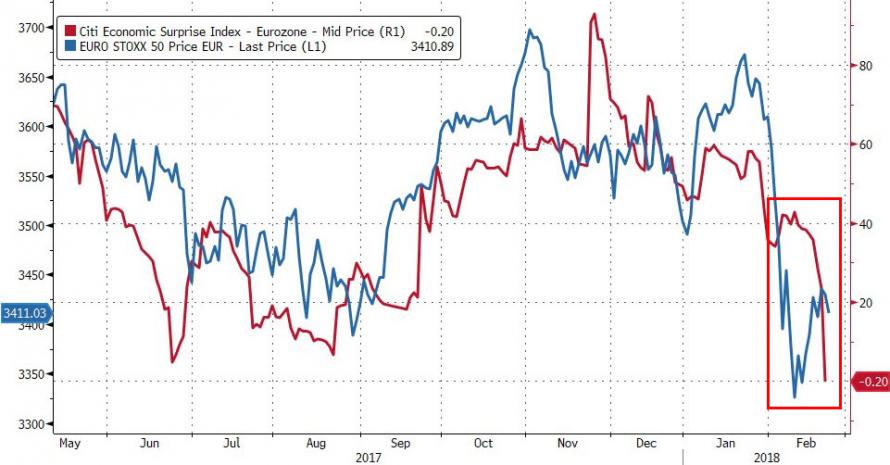

European stocks suffered a death cross today as European Economic crashed into the red…

This week the Euro Area Economic Surprise Index (ESI) turned negative for the first time since September 2016.Negative surprises in soft data (e.g. PMIs) have contributed to most of the decline which ended the longest positive streak for the index.

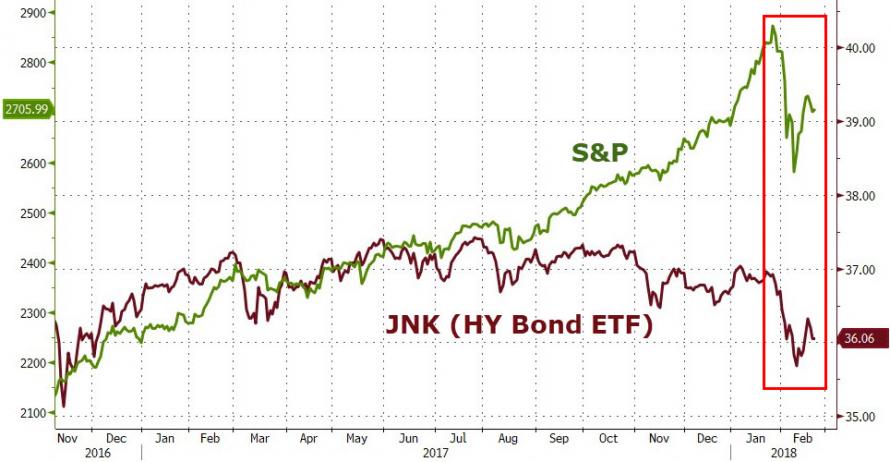

High yield bonds continue to slide…

And HY Spreads are starting to blow out again relative to VIX…

Treasuries were bid today with the belly outperforming the tails…

10Y Yields drifted lower…

On a side note, while the world is watching 10Y Yields, 30Y yields are in a very interesting region of congestion…

Leave A Comment