Fundamental Forecast for Dollar:Bearish

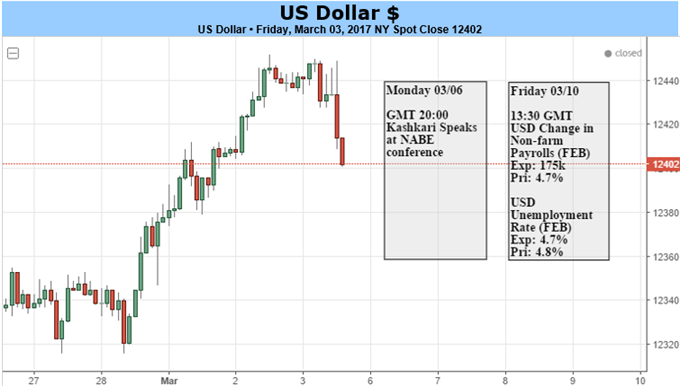

The Dollar’s posture heading into the new week is bullish on the back of a remarkably decisive outlook for a Fed hike at the next official FOMC meeting. According to Fed Fund futures, the market is pricing in a 94 percent probability of a 25 bps increase to the official range at the March 15th meeting. That compares to a far more restrained 40 percent chance afforded to such an outcome only a week before. Yet, despite this fundamental leverage; the Dollar (ICE Index) only rose 0.28 percent – with peak gains against the New Zealand Dollar of 2.4 percent all the way to a weekly loss against the Euro. This restraint from the Greenback in the face of exceptional fundamentals should trouble Dollar bulls. Further gains through the coming week will likely prove more difficult to muster while the sensitivity to troubles will find a more receptive crowd. With that, events like Friday’s NFPs look more risk than opportunity for bulls.

It is perhaps a little facile, but a market that does not respond positively to a significant improvement to its fundamental backdrop is bearish. That’s not to say that the market is in the process of tumbling nor is it inevitable; but it does suggest that there is an asymmetrical balance of opportunities. We find the Dollar in exactly this position. Looking ahead, the docket is relatively light for domineering event risk for US investors. At the very top of that short list is the February nonfarm payrolls (NFPS) due on Friday. That indicator has a direct line to rate speculation through years of speculative association via the ‘dual mandate’. What would we expect from a truly impressive outcome for this labor report? With the markets already assuming a hike, there is little more to squeeze from such an outcome.

Leave A Comment