Even though the conflict in Syria can rapidly escalate, investors were feeling more comfortable with risk over the last few days. The US trade rhetoric was toned down several decibels, and this helped.US President Trump saw signs of concessions from China’s President Xi speech. Trump suggested that negotiations were underway and that an outcome in which there are no new tariffs implemented is still possible. NAFTA negotiations were also promising.

Equities rallied and the currencies that often do well when short-term participants have a greater appetite for risk, like the dollar bloc, did well, and the currencies used for funding, like the yen and Swiss franc did relatively worse. Sterling’s rise is also notable. It will carry a six-day advancing streak against the dollar into next week, and rose to new highs since last May against the euro.

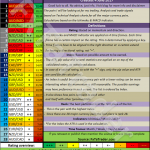

The Dollar Index has been in a range of 89.00 to 91.00 for two months. It is a little below the mid-point. The protracted sideways movement neuters the technical indicators. There does seem to be an underlying bid that was not there at the start of the year. Over the past 11 weeks, the Dollar Index has fallen in only three, including last week’s 0.35% decline. That net-net it has not gone anywhere is a worrisome sign. It does not appear to be a function of the bulls buying from the bears and accumulating a long position. It seems to be more the case that some shorts were reduced, but that the bears remain content and the bulls are not prepared to make a strong stand.

The euro, which is the single biggest component of the Dollar Index also remains in a range. The bottom is near $1.22 and the top near $1.24. There were a few violations last month but attempts to play a breakout were quickly punished. The fact that the euro has gone nowhere in the face of widening differentials (two-year spread has widened from 200 bp to nearly 300 bp over the past six months), fairly consistent downside data surprises this year, and the ECB pushing unusually hard against hawkish comments by one of the national central bank governors, speaks to its resilience. Three-month implied volatility has now completely unwound the run-up in the middle of Q1 and below 6.5% is the lowest since mid-January. There may be some more scope for a near-term decline, but it has not been below 6% since 2014.

Leave A Comment