Bulletin headline summary from RanSquawk

The Dollar Index sank to its lowest level since September, a fresh 10-month low, after two more Republican defections on Monday night doomed the proposed GOP healthcare plan in the Senate. And while Treasuries rose on concerns about inflationary pressures and the viability of the Trump stimulus agenda, S&P futures rebounded gingerly from session lows, and were up 0.01% after posting nominal declines earlier in knee-jerk reaction to the Senate news.

The sliding dollar sent the Euro surging as high as 1.560, the highest since May of 2016, and sending European lower for first time in five days amid concern a stronger euro would damp exporters earnings.

“Any hopes of dollar support from a successful vote on the Senate’s health-care bill look to be vanishing,” said Rodrigo Catril, a currency strategist at National Australia Bank quoted by Bloomberg. “Near term, the dollar path of least resistance is down. We still think the data – inflation in particular – will provide the Fed with enough ammunition to hike in December and boost the dollar, but this is a fourth-quarter story.”

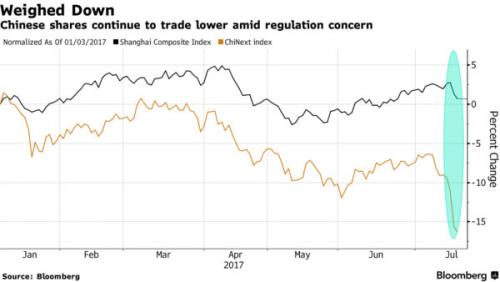

There were no Chinese fireworks today and no ChiNext “Black Tuesday” largely because Beijing was determined to stop the rout after what appeared to be another “national team” intervention in the last two hours of trading. Earlier in the session, Chinese stocks fell after Monday’s selloff as concern about tougher regulations still unnerved the market.

Sunac China Holdings tumbled in Hong Kong after a local media report that banks are reviewing the company’s credit risk. The Shanghai Composite had dropped as much as 0.6% at the midday break local time after falling 1.4% on Monday, its biggest one-day plunge in seven months, while the ChiNext gauge slipped 0.8% after sinking 5.1% on Monday, however the now familiar late trading levitation sent the SHCOMP up 0.4% while the ChiNext closed 0.7% higher. Meanwhile, Sunac China – which we will have more to say about later – plunged as much as 13%. The company, one of China’s most aggressive acquirors, has seen its proposed plan to buy Dalian Wanda assets trigger concern among lenders and Beijing.

it was a busy overnight session in macro with the Aussie soaring to the highest since May 2015 after upbeat RBA minutes flagged improved 2Q growth alongside expectations of increased fiscal spending while suggesting growth is picking up and the estimated nominal neutral cash rate at 3.5%. The announcement caught AUD shorts wrongfooted and started a major squeeze while sending Australian 3-month bank bills sharply lower in heavy selling while 3-year yield rose as much as eight bps to 2.11%. To stabilize the financial system ahead of a surge in liquidity demands, the PBOC injected net 170 billion yuan of liquidity which some however said would not be enough and as a result interbank rates jumped the most in one month; the Yuan gained against dollar while the Shanghai Composite 0.6% lower. Dalian iron ore jumped 4.8% with futures hitting the highest level since May on strong demand from Chinese steel mills.

Tempered expectations for Trump’s spending plans weighed on European bond yields which edged lower, tracking U.S. equivalents, after the collapse of the second healthcare bill. U.S. 10-year bond yields fell after the news, while German 10-year yields dipped 2 basis points to 0.57 percent when European trading started on Tuesday. In European stocks, the Stoxx Europe 600 Index fell following a grim earnings report from Ericsson AB, which led the decline.

Elsehwhere, the pound tumbled by 100 pips to just above 1.30 after UK CPI disappointed to the downside, sliding to 2.6%, from 2.9%, missing expectation, potentially putting the BOE’s rate hike expectations on hold.

Meanwhile, in the US, S&P futures were little changed ahead of earnings reports by Bank of America and Goldman Sachs. IBM reports after the close.

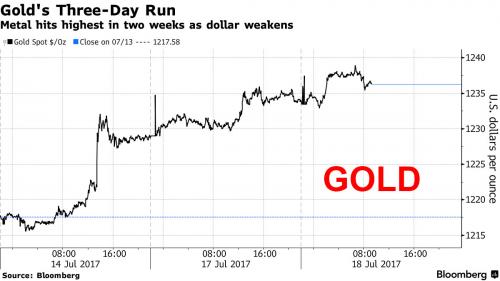

In commodity markets, oil prices steadied as expectations of firm demand, particularly from China, was met ample supply despite Ecuador announcing it would exit the OPEC production cut deal. Brent crude futures eased 0.1 percent to $48.35 a barrel while U.S. crude oil fell 0.2 percent to $45.93. The ongoing dollar weakness sent gold higher for another day, with the yellow metal trading as high as $1,238 overnight.

Market Snapshot

Leave A Comment