Talking Points:

– A vitally-pertinent theme for Financial Markets moves into the spotlight this week with the December FOMC meeting. A 25 basis point hike at this meeting is largely assumed; but more pressing will likely be how aggressive the bank may be looking to hike in 2017.

– Also of issue is the continuation of Yen-weakness along with the recent rise of British Pound-strength. With British inflation numbers to be released on Tuesday and a Bank of England meeting on Thursday, we’ll likely see considerable attention around GBP.

This is another week loaded with potential drivers for global markets. We hear from four major Central Banks, and we’ll see another major theme come to question with the release of British inflation numbers tomorrow. If you’d like a quick preview of the top three events for this week, we looked at that on Friday. For today’s article, we’re going to look at three of the most pressing price action themes for global markets as we head into this heavy week of data.

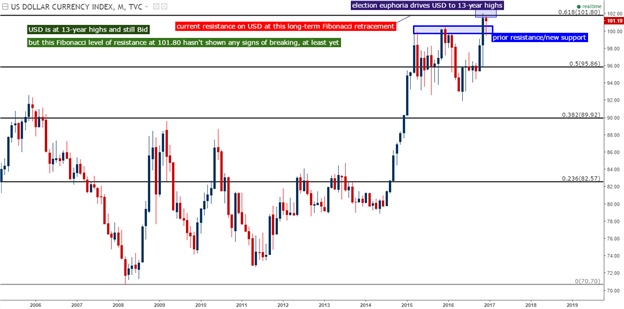

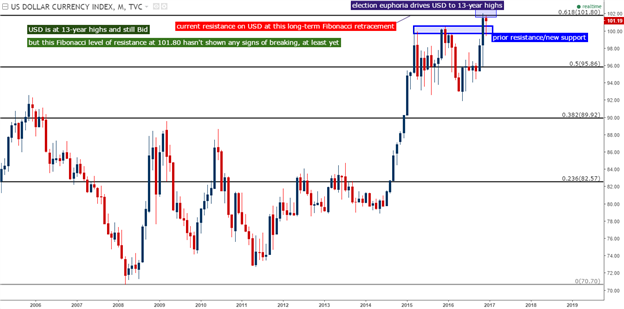

Dollar Strength

This is rather obvious and it’s been a pertinent driver in markets since the brisk-reversal posed in the Greenback on the night of the elections. What was first aggressive weakness in the U.S. Dollar, likely driven by the uncertainty of a Donald Trump presidency, turned into scalding strength that’s continued pushing the U.S. Dollar-higher for the better part of the past month.

?

Chart prepared by James Stanley

This will be directly in the spotlight on Wednesday for the Federal Reserve’s December meeting. At this upcoming rate decision, a 25 basis point hike is largely assumed as a given, and this doesn’t even really appear to be up-for-debate. The bigger question is how many hikes the bank might be looking for in 2017 with their larger goal of ‘policy normalization.’

At the last Fed meeting in December, the bank hiked rates for the first time in over nine years. But when doing so – they also said that they were looking to hike a full four times in 2016; and for an environment that just saw considerable discord throughout 2015 as the bank tried to stage a single 25 basis point hike, this degree of ‘hawkishness’ for future rate policy seemed a bit out-of-place. Within two weeks of that rate hike and markets had already begun to collapse. And six weeks after that, Janet Yellen staged a rather pronounced pivot of dovishness at her twice-annual Humphrey Hawkins testimony; and this brought expectations for near-term rate hikes out of the Fed significantly-lower.

Leave A Comment