by Dirk Ehnts, Econoblog101

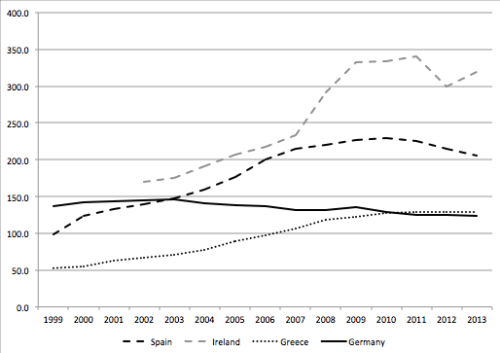

For my new book on money and credit in the euro zone I use data on domestic credit to the private sector. Oddly enough, the data has been changed and is now significantly lower than before. The credit bubble has popped! The World Bank has the data series online (here). Domestic credit to GDP in Spain stood at 127.4 in 2014, down from a bit less than 200 in 2012. What?!

As you can imagine, I was quite surprised by this change in data. It turned out that the data has been changed all the way back to the early 2000s. After an inquiry, World Bank told me that they would get the data from the IMF. The IMF then told me that they get more detailed data now from the ECB. I told them that their calculations must be wrong. I went to the ECB website and did my own calculations:

So, Spanish domestic credit to the private sector divided by GDP at market prices is still above 200%! A quick comparison with my older data confirms that the private debt is even higher than was published before. What is also interesting is the German credit boom that isn’t. The flat line doesn’t budge upwards, and this means that there is no additional net injection of bank deposits from the German private sector. Without the needed addition to purchasing power German domestic demand will remain low, and this means that the euro zone will not be getting the expansionary stimulus it needs. This should explain why Mario Draghi increases his efforts at QE, trying to push the euro lower.

This currency war is the consequence of the taboo of European governments to use fiscal policy. So, the euro zone is intent on exporting its unemployment elsewhere. China, Japan and the US won’t like this at all.

Leave A Comment