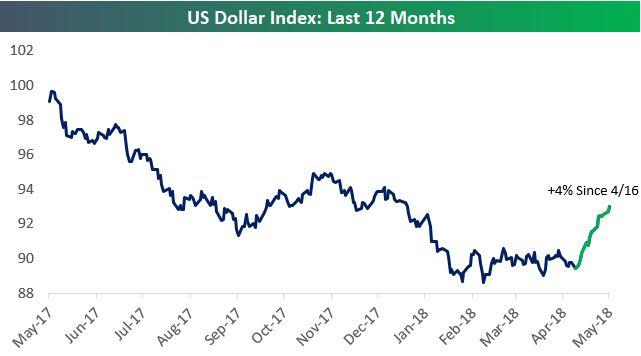

As shown in the chart below, the US Dollar index is up 4% since it took off on April 16th.

Dollar strength hurts US companies that generate significant revenues outside of the country, and it benefits companies that generate the bulk of their revenues domestically.

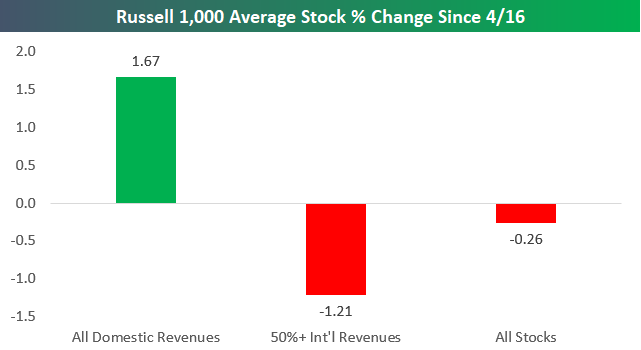

Since April 16th when the Dollar began its current rally, we’ve seen “domestic” stocks outperform “internationals” by a wide margin.Using our International Revenue Database that’s available to Bespoke Premium and Bespoke Institutionalmembers, below we show that Russell 1,000 stocks that generate 50%+ of their revenues outside of the US are down an average of 1.21% since 4/16.On the flip side, Russell 1,000 stocks that generate all of their revenues domestically are up an average of 1.67% over the same time period.

This is clear evidence that the Dollar’s movements are impacting stock prices.

Leave A Comment