2 days ago we looked at why gold and silver are in the process of making a short-term bottom.

However, I also said that while gold and silver are in the process of making a short-term rally, their long-term prospect is not bullish. Gold and silver are exhibiting price action that’s typical of big gold and silver bear markets (periods during which gold and silver swung sideways for years, if not decades).

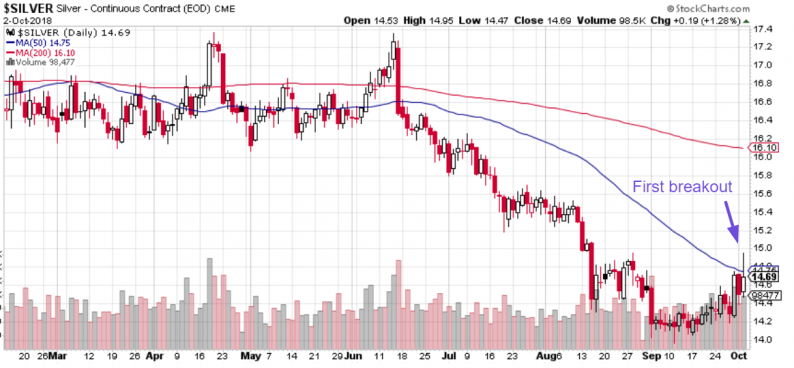

Today, silver’s daily HIGH exceeded its 50 day moving average for the first time in a long time (75 trading days).

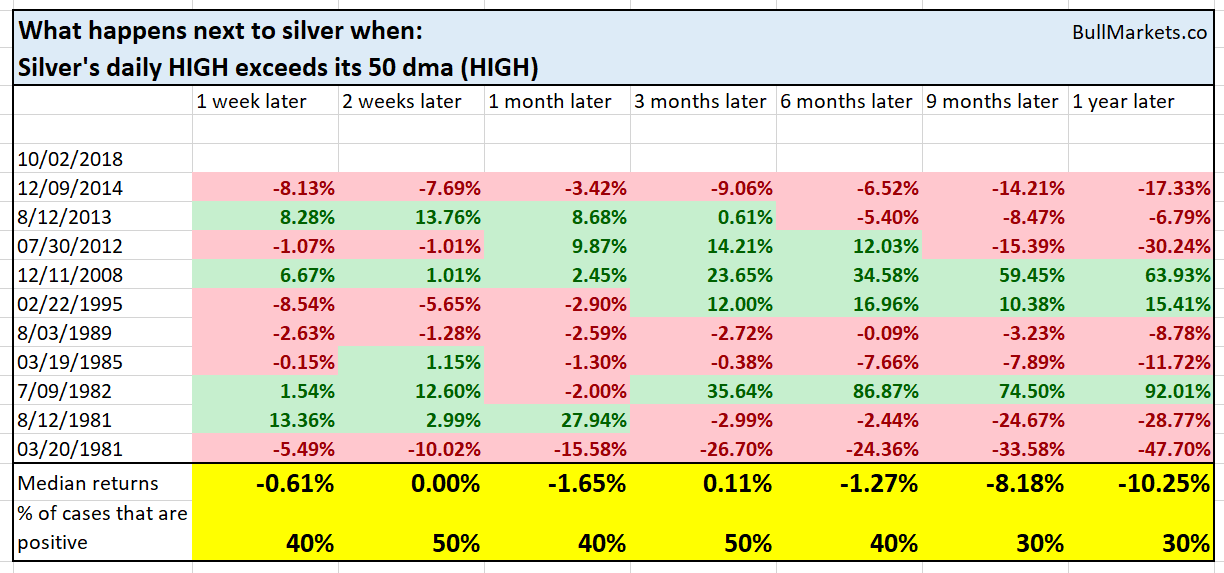

Here’s what happens next to silver (historically) when silver exceeds its 50 dma for the first time in 75 days.

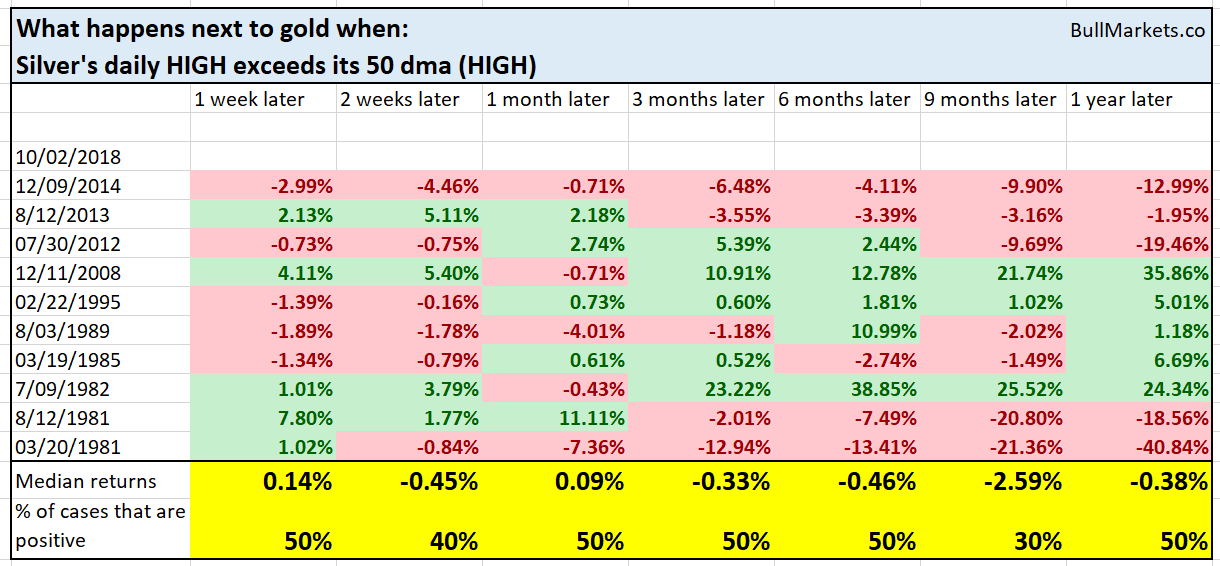

Here’s what happens next to gold (historically) when silver exceeds its 50 dma for the first time in 75 days.

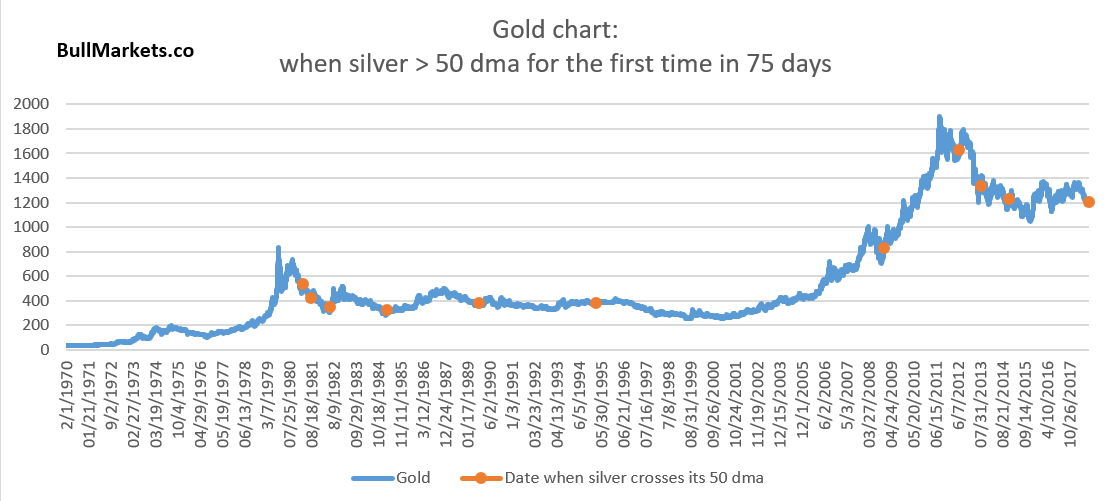

Here are the cases, overlapped onto a long-term gold chart.

Conclusion

As you can say, while gold and silver may be in the process of making a short-term rally, this is not a long-term bullish sign for precious metals. This is because the gold & silver downtrend prior to the current bounce was so severe that it doesn’t happen during bull market corrections.

So if you’re long precious metals right now, don’t expect to buy and hold them for years.

Leave A Comment