Fundamental Forecast for EUR/USD: Neutral

– EUR/USD losing ground in May falls in line with twenty year seasonality trends.

– The retail crowd remains net-short EUR/USD but shifting rapidly – see live SSI updates.

– Check in on the EUR/USD quarterly forecast, “EUR/USD Stuck in No Man’s Land’s Headed into Q2’16 – Don’t Discount ‘Brexit’”

To receive reports from this analyst, sign up for Christopher’s distribution list.

The Euro fell back against the British Pound (EUR/GBP -1.62%) and the US Dollar (EUR/USD -0.91%) last week while gaining broadly elsewhere. Current market trends seem likely to continue going forward as both the British Pound’s and the US Dollar’s catalysts – the probability of a ‘Brexit’ falling in recent polls and the market pulling forward Fed rate hike expectations, respectively – remain two of the strongest forces across global markets.

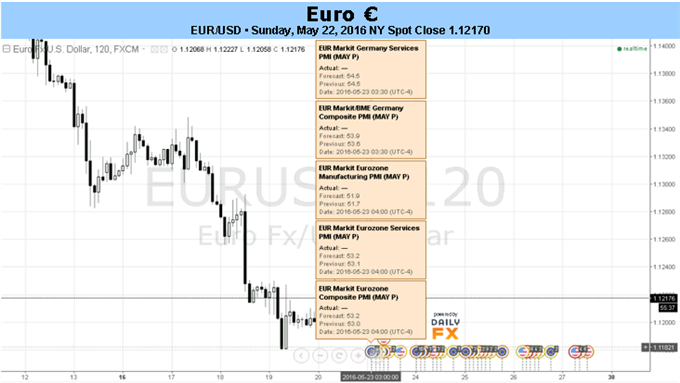

With the upcoming slate of Euro-Zone economic data set to show growth conditions improving, don’t be surprised if you see more of the same from the Euro over the coming week – potential for EUR/GBP and EUR/USD weakness (positioning certainly isn’t in the way), while other EUR-crosses could stay elevated. While there are no “high” rated events on the DailyFX Economic Calendar for the coming week for the Euro, there are almost twenty “medium” ranked events that bear enough significance to drive price action across the EUR-crosses.

Right now, a steady improvement in Euro-Zone economic data has been helping support the Euro broadly speaking. The Citi Economic Surprise Index closed last week at +0.80, its highest level since January 21 (coincidentally, the day of the European Central Bank’s January policy meeting). Incoming economic data over the coming days should support further gains in economic data momentum.

Leave A Comment