Key Takeaways

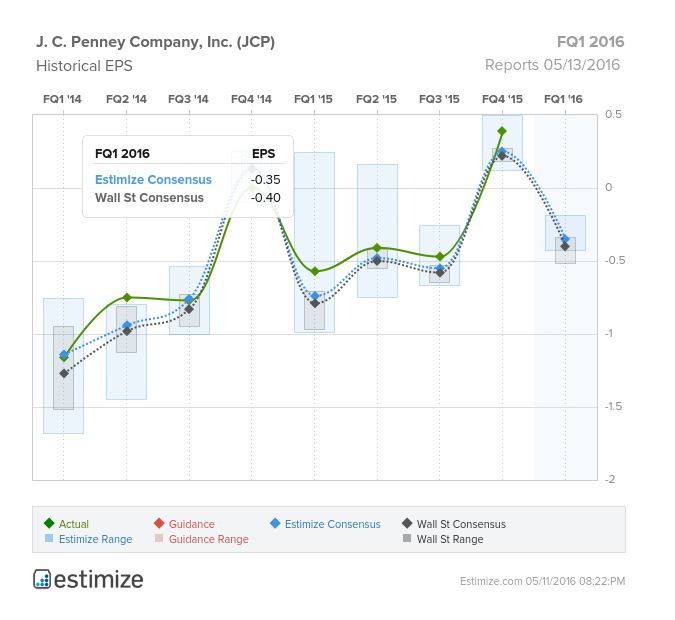

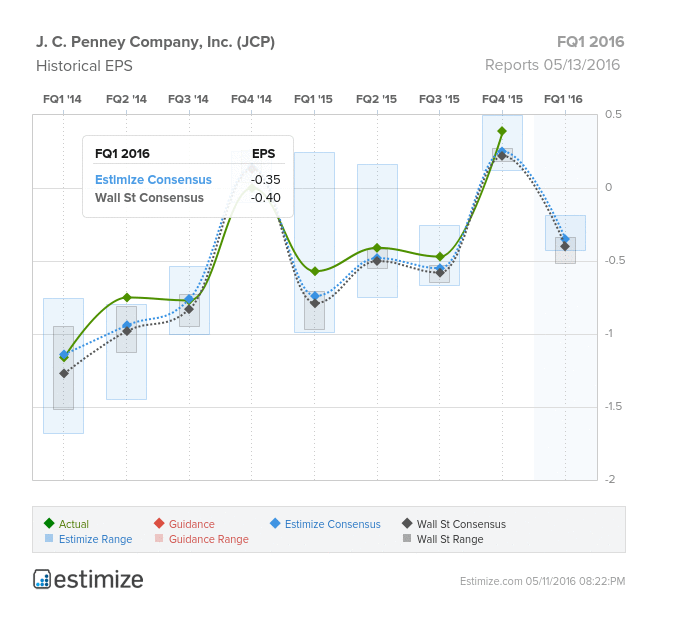

On the verge of bankruptcy, JCPenney has made a remarkable turnaround in the past few years. Consumers are shying away from higher end department stores like Macy’s and Nordstrom’s in favor of discounters like JCPenney. This has been huge for the stock which is already up 20% on the year. The Estimize consensus is looking for a loss of 35 cents per shares on $2.94 billion in revenue, 4 cents higher than Wall Street on the bottom line and right in line on the top. Earnings per share estimates have increased 13% since its last report and now predict 39% growth from a year earlier. On average the stock is a positive mover leading up to earnings and then turns negative by 2% in the 30-day post earnings period.

This quarter, JCPenney is expected to be the biggest winner amongst department stores. The low end retailer crushed the holiday season with reported earnings per share that were 15 cents higher than expectations. The quarter also featured a 4.1% increase in comparable store sales, with additional gains coming from online sales. For 2015 comp store sales grew 4.5%, free cash flow improved by 130% and the company retired $500 million of debt. As a result, the stock is up over 20% since the start of year. Strong numbers were primarily driven by an increased focus on its omni channel capabilities, expanding store-in-store Sephora sales and deeper penetration of its private brand. JCP has already indicated that first quarter profits will come in higher than expected, providing reassurance to investors that worry its turnaround is coming to an end.

Leave A Comment