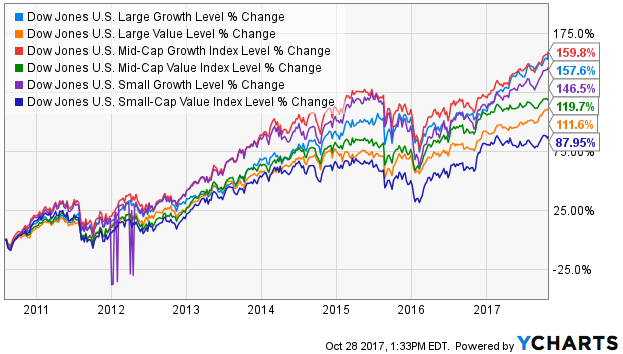

The rising tide of the stock market has lifted all boats over the past several years, but it’s lifted some more than others. Look at returns from just about every time period over the past decade or so, and you’ll find one segment almost always come out on the bottom – small cap value. In fact, small cap value has underperformed significantly over the current decade.

Growth stocks have been all the rage for the last several years, but have been especially so in 2017. The FANG stocks – Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOG) – along with tech heavyweights Microsoft (MSFT), Apple (AAPL) and Tesla (TSLA) are all up more than 30% this year. Small cap value had a good year in 2016, but it was the worst performer of the six major categories in 2014, 2015 and, if the current pace continues, 2017. The growth stock boom even persuaded Greenlight Capital hedge fund manager, and noted value investor, David Einhorn to ask if value investing is dead.

The short answer is “no”. Value investing is not dead. During the tech bubble, there were people that said the Nasdaq’s rise from around 1500 in the beginning of 1998 all the way to over 5000 a little over two years later was merely the start of a parabolic move higher that would reflect the massive growth of our economy thanks to the internet. We know how that turned out. During times of euphoria, and there’s mounting evidence to suggest that the current environment is becoming one, it’s easy to feel that the current paradigm will continue indefinitely and traditional methods of valuing securities are no longer valid. If there’s one thing that the stock market has taught us over and over, it’s that the law of averages tends to catch up over time.

One of my favorite Warren Buffett quotes is, “be fearful when others are greedy and greedy only when others are fearful”. Which brings me back to the small cap value segment. If Buffett’s mantra is true, now could be the time to get greedy in adding small cap value stocks.

Leave A Comment