As one smart CNBC chap argued “you’ve been paid to optimistic”…

But then again “ignorance is bliss”…

Stocks rallied today.. because… oil…

As WTI Crude surged to a 15-month high today…

Just one question… what happens next?

Trannies and Small Caps were best as Nasdaq limped along unch hurt by Intel…

Something odd of note – 6 days in a row with a weak close and notice last 3 days a VIX push has not helped (some chatter about index ETF rebalancing questions on desks)

As “Most Shorted” stocks squeezed higher for the second day…

Two notable mini-flash-crashes in VIX today (and a broken market) got the S&P back above its 100DMA (2142)

The Dow also broke above its 100DMA (18,207)

The big news in bond land was the large Saudi issuance…

But it appears there was little rotation our of Treasuries or rate locks ahead of this…

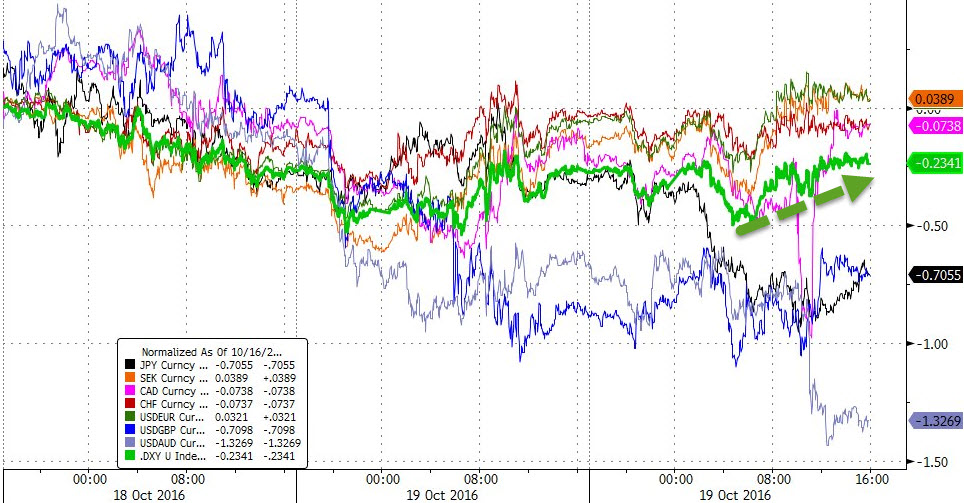

The USD Index managed to eke out a small gain (as AUD and CAD saw yuuge volatility intraday)

CAD swung around on oil’s pump and dump and BoC’s comments…

Gold and Silver gained despite some USD strength, Copper was flat and Crude pumped-n-dumped…

WTI broke above recent highs to 15 month highs but appears to have run stops and faded…

Gold rose for the 3rd day in a row (first time in 6 weeks) testing back above its 200DMA ($1272)

Leave A Comment