From 2011 through 2016 foreign investors gained from rising US equities and the rising dollar. Both have now reversed.

US equities from a foreign perspective looked very attractive, helped by a rising dollar.

When the dollar reversed, US equities only looked attractive if the rise in equity prices exceeded the fall in the dollar. That they easily did for a year.

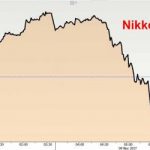

S&P 500

Now What?

If you think I know you’re crazy. No one else knows either.

But I can discuss the fundamental macro picture.

Fundamentals

Regarding point number three, no one knows what crazy things other countries may do. And although concerns have dropped to near-zero that the Eurozone will break up, there is a far greater than zero chance Italy says to hell with it all. That could feed another euro crisis and a rush to the dollar, but equites are another matter.

Point number two will not vanish no matter what Europe does.

US equities have been enormously overvalued for years from any standpoint but that is especially true from a foreign standpoint right now.

Related Articles

Leave A Comment