Dividend Kings, companies with 50+ straight years of dividend growth, are the epitome of dependable long-term income growth investments.

Dover (DOV), an industrial blue chip, is even more impressive having grown its payout 9% annually over the past 30 years, and the company is about to announce its 62nd consecutive annual dividend increase.

Let’s take a closer look at why Dover has proven to be such a consistent dividend grower, what investors can expect going forward, and if now could be a reasonable time to add this dividend king to a diversified income portfolio.

Investors seeking greater current income than the 2.3% yield Dover offers can review some of the best high dividend stocks here instead.

Business Overview

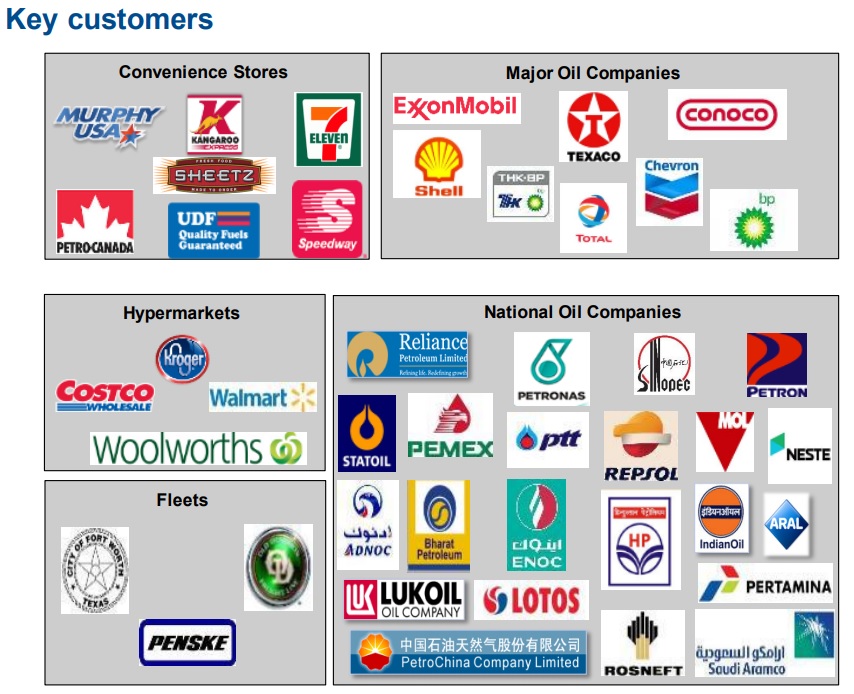

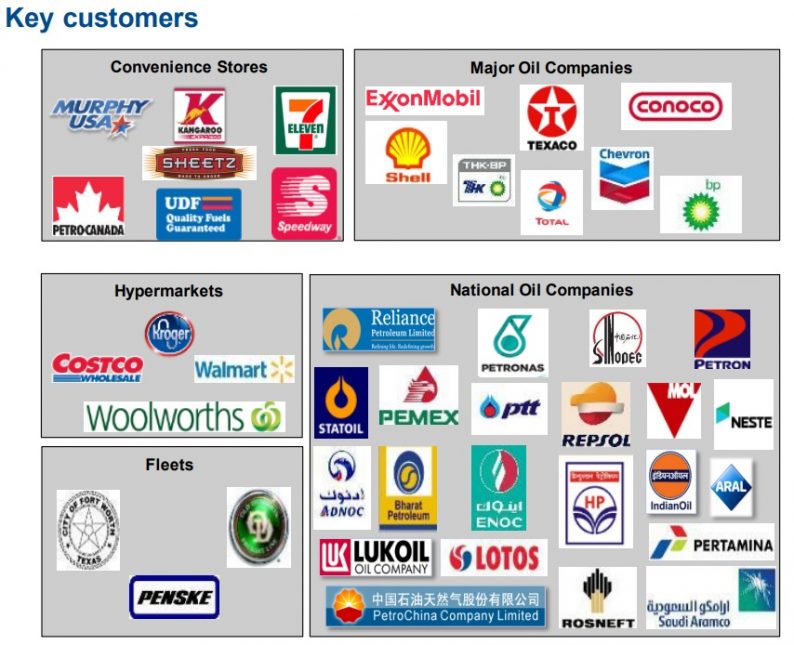

Founded in 1947 in Downers Grove, Illinois, Dover is an international industrial conglomerate whose 29,000 employees serve a global client base through four main business segments.

Energy: products include artificial lifts, pumps, sensors, and monitoring solutions for customers in the drilling and production markets. Dover essentially helps customers extract oil and gas more efficiently and safely.

Engineered Systems: Dover helps drive efficiencies for customers in printing, identification, vehicle service, and waste-handling equipment. Products in this segment include automation components, printing systems, hydraulic components, electronic components, 3D printing tools, and more.

Fluids: products include strategically engineered specialized pumps, tubing, fueling, vehicle wash, and dispensing systems. Dover’s components and equipment are used for fueling and vehicle wash and for transferring and dispensing critical materials in numerous end markets such as chemicals, food, and pharmaceuticals.

Refrigeration & Food Equipment: Dover’s products reduce customers’ total cost of ownership in refrigeration, electrical, heating and cooling systems, and food and beverage packaging. Products include commercial refrigerator and glass doors, lighting systems, food processing and packaging solutions, cooking preparation equipment, and more.

The company essentially delivers a wide range of equipment and components, specialty systems, and support services that are sold to thousands of customers across virtually every end market.

Source: Investor Presentation

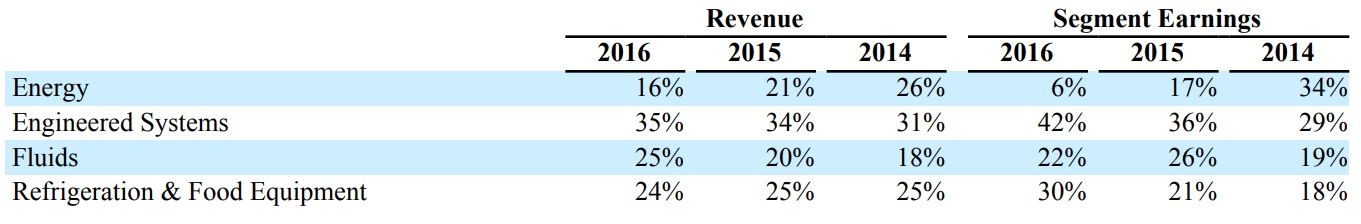

Over the past few years, courtesy of the worst oil crash in over 50 years, Dover’s sales have shifted away from its energy business which used to provide the largest share of its earnings.

Source: Dover Annual Report

The majority of its 2016 sales continue to be from the United States, although its largest growth markets are in emerging markets in Asia and Latin America.

Business Analysis

In order for a company to generate over six decades of continuous dividend growth, it must have both a stable and growing business, as well as some kind of moat to defend market share and margins over time.

In the case of Dover, the company has several competitive advantages in the highly fragmented industrial sector, where it competes for approximately $60 billion in annual global sales (11.3% total market share) across its four business segments.

Dover has largely built up its business through acquisitions over the course of many decades. The company maintains a decentralized organizational structure to stay nimble and entrepreneurial while implementing productivity measures across their businesses.

For example, the Dover Excellence program is its continuous improvement initiative. This creates a culture filled with problem solvers and solution providers for customers, helping Dover maintain its strong market share positions and stay ahead on the innovation curve while generating substantial free cash flow.

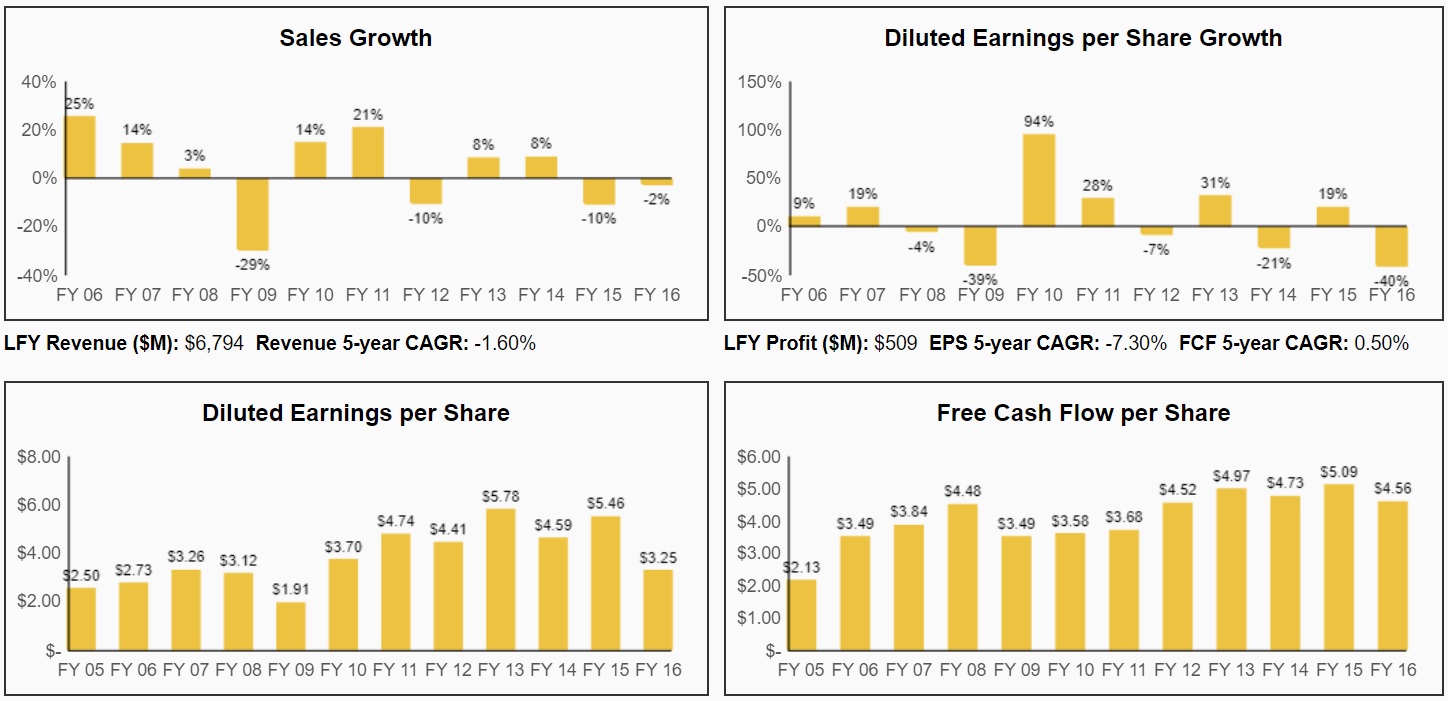

That being said, while Dover’s long-term growth has been steady, it does operate in highly cyclical industries that result in volatile sales, earnings, and free cash flow over the short-term.

Source: Simply Safe Dividends

Dover’s approach to this kind of volatility is to focus on specializing in highly engineered solutions to meet its customers needs.

Dover has built up a portfolio of mission-critical products that serve highly profitable market niches, establishing relationship for quality and excellent customer support and making it a top vendor that customers want to partner with to get their job done right.

Essentially, Dover wants to be a “one-stop shop” to provide entire systems to help its customers with their oil pumping, consumer goods printing, fluid handling, and refrigeration needs.

Leave A Comment