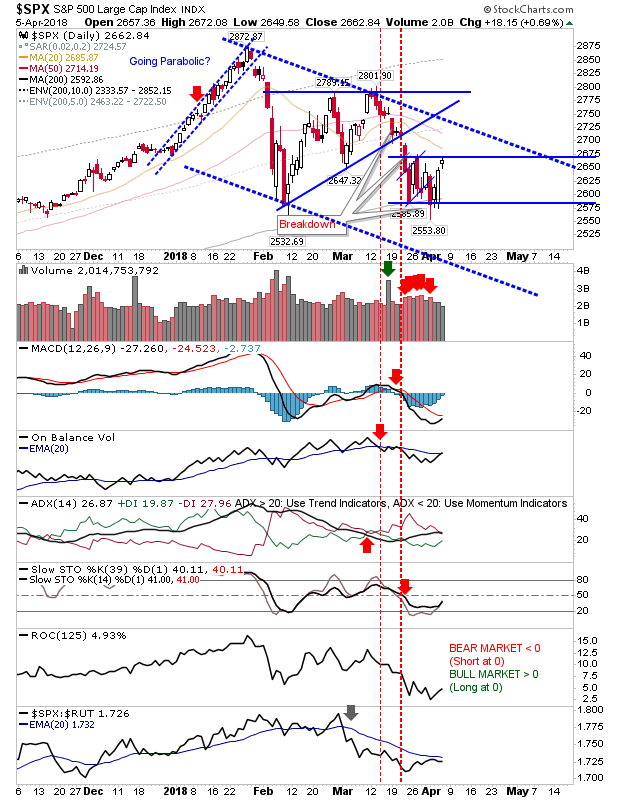

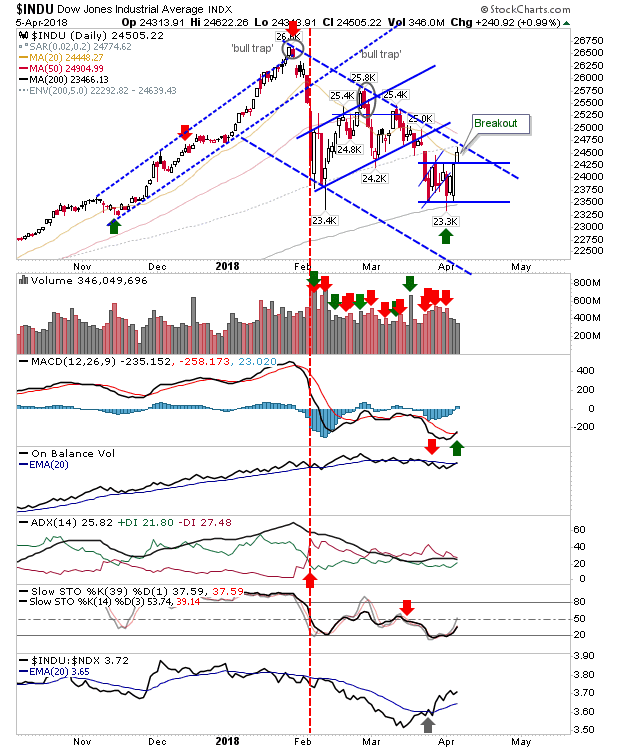

Markets look to have found a new routine with 200-day MAs acting as working support. The ‘bear flags’ I had marked for the S&P and Dow Jones Industrial average look toast given the latter index has broken resistance from what now looks to be a horizontal consolidation. However, the larger consolidation from all-time highs has yet to be challenged but could see a test Friday or Monday.

The S&P hasn’t quite followed in the footsteps of the Dow Jones and is mapping a sideways consolidation but didn’t manage a breakout. However, today’s action in the Dow gives it a chance.

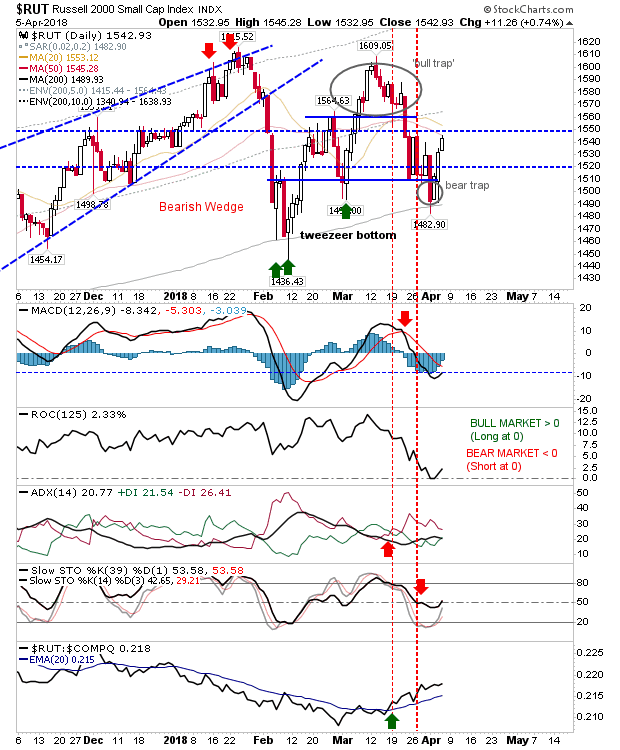

The other index doing well for bulls is the Russell 2000. The bounce off the 200-day MA recovered the tweezer bottom swing low and has left a new ‘bear trap’. Next is a rally to challenge the March ‘bull trap’ above 1,550. The index is in a good position to do so with the recovery of stochastic mid-line and the acceleration in relative performance (vs the Nasdaq).

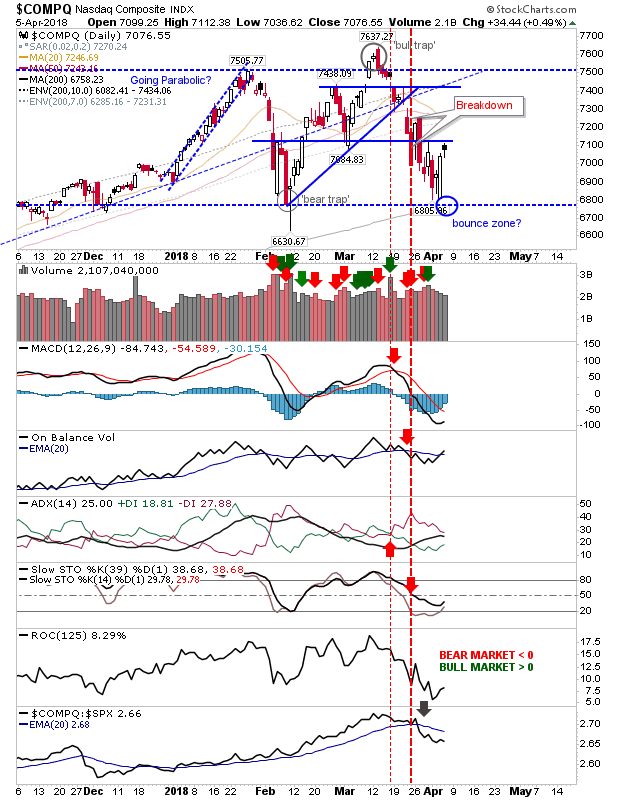

There wasn’t a whole lot to Tech action. Today’s trading was focused elsewhere so little to add to Nasdaq and Nasdaq 100 action. Today’s ‘black candesticks’ would normally be considered bearish when they occur at a swing high but in the middle of a trading range they are less threatening.

For tomorrow, bulls can look to the S&P to follow the Dow Jones Industrial average, with the latter index looking to clear the larger 3-month consolidation. Shorts can look to the Nasdaq; a break of the ‘black candlestick’ low opens up the trade with a stop above the candlestick high.

Leave A Comment