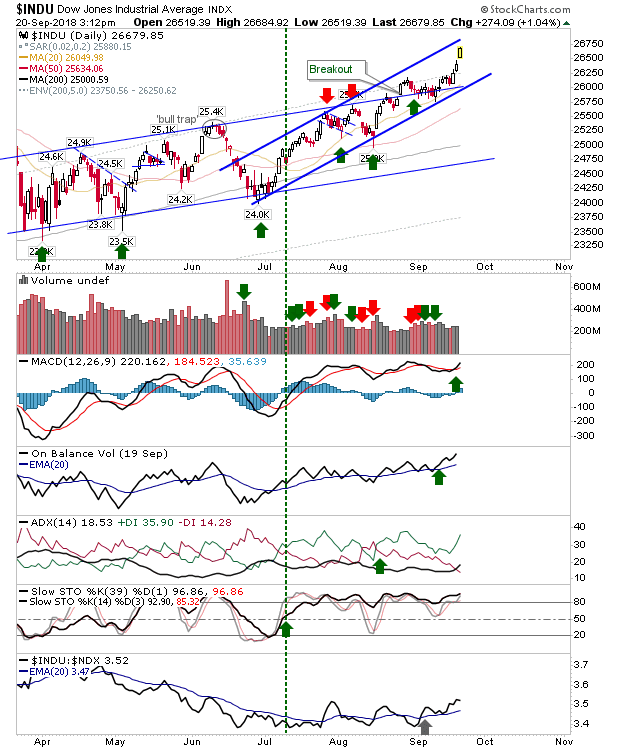

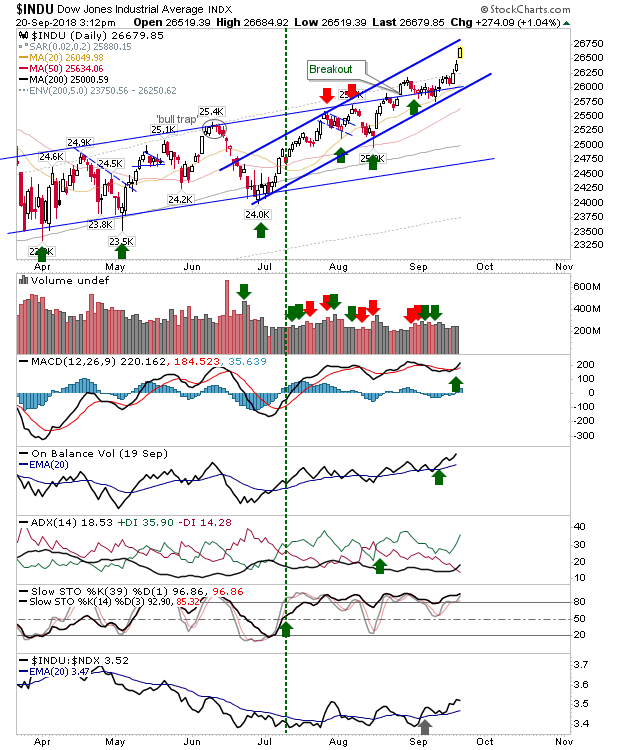

Solid gains across the board but it was holders of Dow Jones stocks which had the best of the action, continuing a sequence of gains triggered earlier this week. The Dow Jones Industrial Average will soon be dealing with channel resistance but not until Friday if not early next week. Technicals are good. The benefit of this strength was seen elsewhere too.

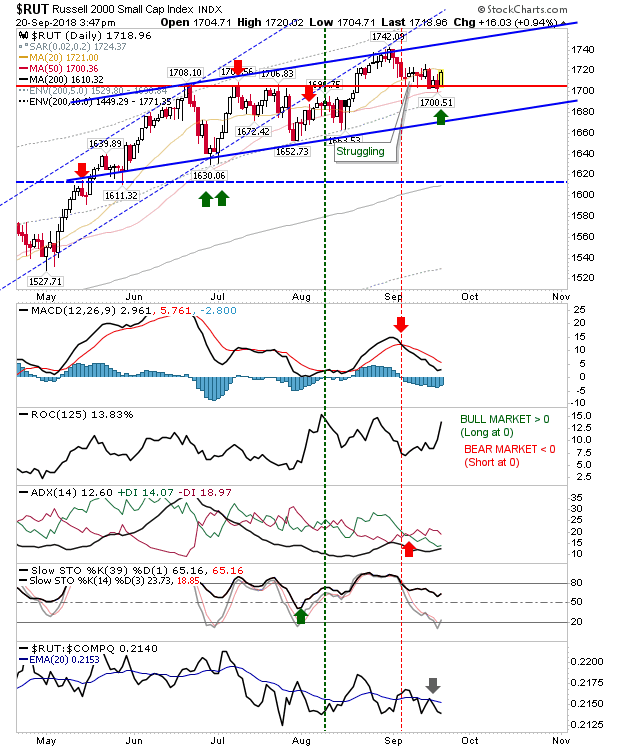

The Russell 2000 looks to have done enough for a new ‘buy’ signal. Yesterday’s decline didn’t undercut the 50-day MA and today’s advance looks ready to take it up towards newly drawn channel resistance. The risk for this trade would be measured by a loss of 1,700 so you would be looking for an ideal target of 1,780 but channel resistance looks the logical profit take point.

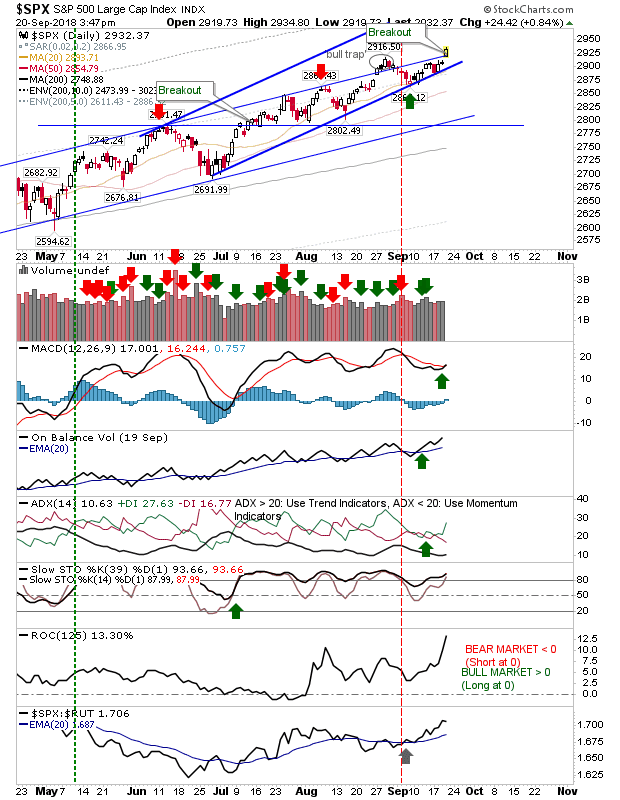

While the Dow Jones index is doing the legwork, the S&P did enough to negate the ‘bull trap’ and bring the upper channel back into play.

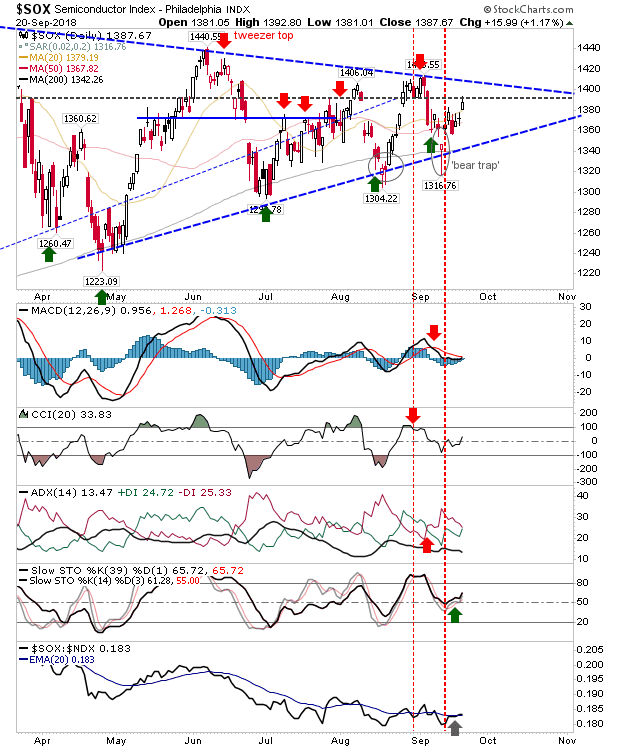

Tech indices were not left out of today’s gains. Existing long trades hold. Semiconductors are range bound and I have redrawn support to encompass the two most recent ‘bear traps’. Technicals are a mixed bag which reflects the indecision of Semiconductor traders.

Leave A Comment