600 points. Dow plunged so much yesterday. The S&P 500 and Nasdaq also suffered. The persistence of losses is disturbing. Should, then, gold shine?

Bears Are Back in Town

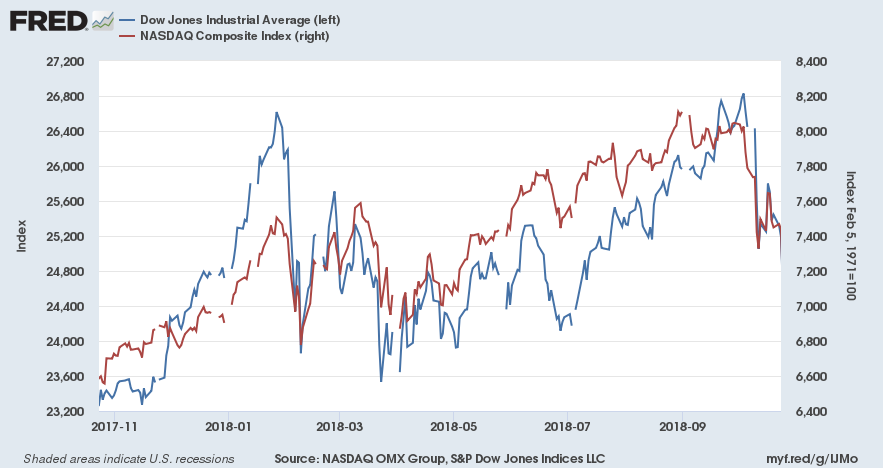

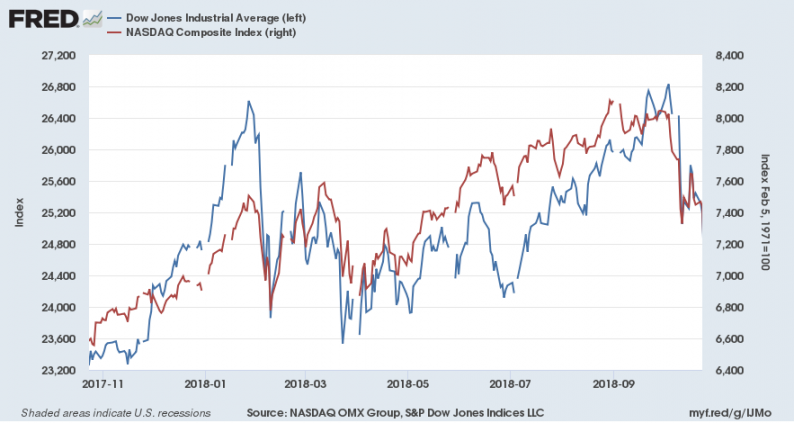

The stock market sell-off continues. Yesterday, the Dow Jones Industrial Average dropped more than 600 points. It means that the index erased all of its 2018 gains, as one can see in the chart below. Similarly, the S&P 500 fell more than 3 percent, turning negative for the year. In October, the index declined almost 9 percent, the worst monthly drop since February 2009. However, Nasdaq suffered the most on Wednesday, as it plunged 4.4 percent, marking the worst day since 2011.

Chart 1: Dow Jones (blue line left axis) and Nasdaq (red line, right axis) over the last twelve months

So, why does the rout continue? The analysts point out that mixed corporate earnings and weak housing data (the new home sales plunged to the lowest level since December 2016) worried investors. However, what these commentators forget is that markets fluctuate and correct from time to time. The current sell-off is bad, but not as dramatic as the previous ones. In February 2018, we have seen the fastest correction since the 1950s, while in January 2016, when the S&P 500 plunged more than 10 percent in a few days after China devalued the yuan.

Normal Correction or Something Bigger?

What is really disturbing is the persistence of losses. The current sell-off is slower but steadier. What we mean here is the fact that the S&P 500 has declined in 12 of the last 14 days, while in the past we experienced more breaks between bad days. The last time we saw something similar was March 2009.

Has the bear market started? Are we headed for another financial crisis and recession? Well, it is possible. The Fed has raised federal funds rate eight times in the current tightening cycle, after all. And historically, when monetary policy tightened, it never ended well. The correction is, thus, perfectly understandable. The interest rates were too low for too long, so the asset prices have grown too much.

Leave A Comment