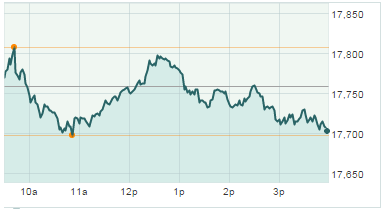

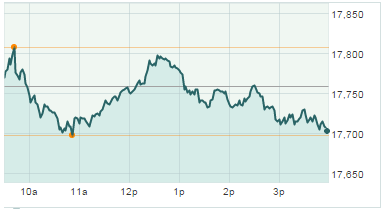

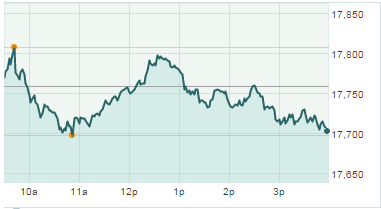

How Did the Sock Market Do Today?

Dow Jones: 17,702.22; -55.99; -0.32%

S&P 500: 2,075.00; -6.72; -0.32%

Nasdaq: 5,067.02; -16.23; -0.32%

The Dow Jones Industrial Average today (Wednesday) dipped 55 points as investors kept a tight eye on shares of brick-and-mortar retailers after a terrible full-year earnings report from Macy’s Inc. (NYSE: M). The markets were supported by gains from General Electric Co. (NYSE: GM) Amazon.com Inc. (Nasdaq: AMZN), which both saw gains of more than 1.7%.

Tomorrow, markets will turn their focus to weekly jobless claims and speeches from six members of the U.S. Federal Reserve, including remarks from central bank chairwoman Janet Yellen, during the Fed’s conference on post-crisis monetary policy. The earnings report calendar will be extremely busy. Companies reporting quarterly earnings on Wednesday will include Cisco Systems Inc. (Nasdaq: CSCO), Fossil Group Inc. (Nasdaq: FOSL), Nordstrom Inc. (NYSE: JWN), Applied Materials Inc. (Nasdaq: AMAT), Kohl’s Corp. (NYSE: KSS), Advance Auto Parts Inc. (NYSE: AAP), and El Pollo LoCo Holdings Inc. (Nasdaq: LOCO).

Top Stock Market News Today

Stock Market News: The bond markets were closed in observance of Veteran’s Day, but the stock markets had a full trading session. Five of 10 S&P sectors were positive today, with utilities largely leading the way. The energy sector was today’s worst performer, falling more than 1.9%. Shares of Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX) were both off more than 0.8% on the day. It was a brutal day for offshore oil drillers. Shares of Atwood Oceanics Inc. (NYSE: ATW) fell nearly 13%, while W&T Offshore Inc.(NYSE: WTI) was off 12.5%.

Oil in Focus: Oil prices fell again on news U.S. domestic crude inventories rose last week. It was the seventh straight week the U.S. government reported an increase in crude stocks. Inventory levels surged another 6.3 million barrels last week, fueled by a very large gain at the Cushing, Okla., delivery point. Analysts had only expected a build of 1 million barrels. December WTI prices fell 2.6% to hit $43.05, while Brent oil crude – priced in London – dipped 3.1% to hit $45.93. The decline in oil prices led to a 1.9% decline in energy stocks.

Hunter Hiccup: The oil price plunge has crushed another victim: Shares of Magnum Hunter Resources Corp. (OTCMKTS: MHR) sank roughly 40% Tuesday before trading was halted. The independent oil and gas company has been delisted by the New York Stock Exchange over its share price. Here’s the real story of what happened.

Saudi Oil Minister: Earlier this week, Saudi officials announced the nation has no plans to reduce its oil According to leaders, the country plans to maintain oil productionin order to protect market share, even though possible cuts would help stabilize oil prices around the world. Here’s how that decision will affect oil prices heading into 2016 and beyond.

Leave A Comment