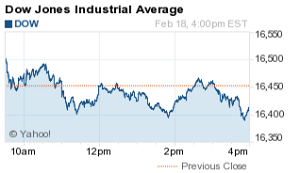

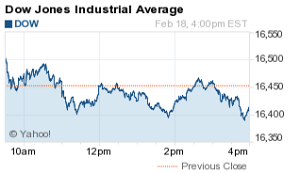

Rallies don’t last forever, that’s what the baseball coach used to say. The same can be said about the markets, as the Dow reversed after a three-day winning streak. Investors can blame weak earnings reports and a sluggish performance from the banking sector. That said, savvy investors still found a way to make money no matter which way the market headed.

First up, check out the big gains for the Dow Jones Industrial Average, S&P 500, and Nasdaq today:

Dow Jones: 16,413.43; -40.40; -0.25%

S&P 500: 1,917.83; -8.99; -0.47%

Nasdaq: 4,487.54; -46.53; -1.03%

Then read today’s top stock market news today…

DJIA Today: Wal-Mart Slumps, IBM Jumps, and MRO Falls to Earth

First up, the Dow was held back by Wal-Mart Stores Inc. (NYSE: WMT), whose shares fell 3.1% after issuing a weaker than expected quarterly profit figure and sales outlook. The firm slashed its sales growth forecast through 2017 to “relatively flat.” Its previous estimates said growth would be up to 4%.

The top performer was International Business Machines Corp. (NYSE: IBM), which saw shares pop more than 5% after the technology giant received an upgrade from Morgan Stanley (NYSE: MS). A Morgan Stanley analyst suggested investors are underestimating IBM’s shift into high-growth industries like cloud computing and analytics.

The chatter about the European Central Bank’s desire to abolish its high-denomination currency went full terminal today. The ECB’s President Mario Draghi is looking to eliminate the 500-euro bill as part of an effort to deter financial crimes and put pressure on nations like Switzerland and the United States to follow suit. However, this ploy is likely just another tool to weaken the currency as nations continue on a race to the bottom with high debt loads and negative interest rates. In fact, nearly 500 million people now live in countries with official negative-interest-rate policies, and the United States may be next. Here’s an update on what is happening with the U.S. Federal Reserve and the ECB and why this massive betrayal is just in the first inning.

Leave A Comment