The negative sentiment in tech stocks right now won’t necessarily keep traders from beating each other with a stick to try and get their hands on the newly listed Spotify shares as soon as they open.

At this point, investors are really looking for something fresh and even though the company is losing money, they have more paid subscribers than any Western music streaming service.

The fact that they aren’t introducing any new shares means that nobody can be certain how many will be available to meet the demand. This could get messy.

Today’s Highlights

Traditional Markets

It was the worst start to Q2 since 1929. At one point the Nasdaq was down more than 3.5%. The word bloodbath has been used a few times. The only reason it hasn’t been used more aggressively is that many believe that this isn’t over just yet.

For reference, here is a map of the major corrections in the S&P500 over the last decade. Not included below is the crash of 2008.

One thing that had people particularly worried is the break below the 200 day moving averages on the Dow Jones, something that financial media was calling the “lines of defense.”

All the major stock indices in Asia, Europe, and the USA are currently in the red territory since the beginning of the year.

Sentiment?

Some strange stuff here. As one would expect from a major stock sell-off, we are seeing some buying pressure in gold and in treasury bonds.

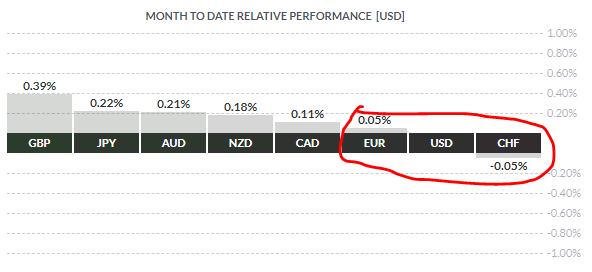

The weird thing is in the currency markets where the safe havens are among the worst performers so far this month.

The only exception being the Japanese Yen which is somehow miraculously rising despite the political tensions in Japan abating.

Cryptos in Green

![Dow[n] Behind Enemy Lines](https://www.riceoweek.com/wp-content/uploads/2014/08/RI-CEO-Week-logo.png)

Leave A Comment