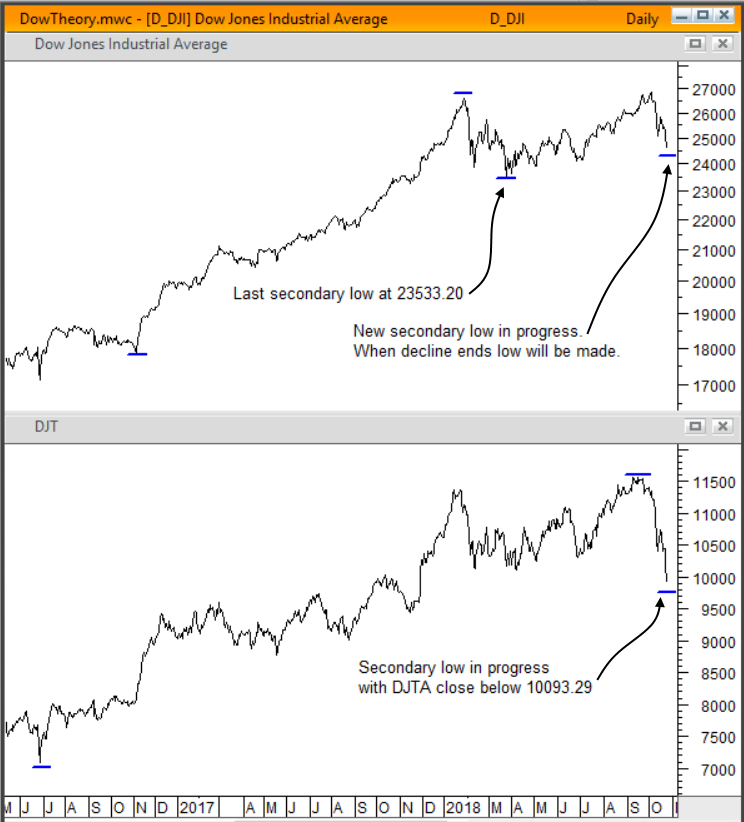

On Wednesday, both the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) closed low enough that they are in the process of forming new secondary lows. A secondary low is a dip in a long-term bull market that retraces between 33% and 66% of the previous rally. They last from about 3 weeks to as much as 3 months. When this current dip ends and the market rallies for more than 3 weeks we’ll have new secondary lows in place. Once that happens, those lows will be the new triggers to signal a long-term bear market if they are broken to the downside. The current triggers are 23533.20 on DJIA and 7093.40 on DJTA. As long as this dip doesn’t break both of those lows we’re still in a bull market.

Since we’re still in a Dow Theory bull market, this is a dip that should be bought. Yes, a dip that should be bought. Most of the methods I use to allocate money for my portfolio are based on reducing risk by hedging or going short when the odds are high that the market will go into an intermediate-term downtrend. Dow Theory, on the other hand, is a LONG TERM system of allocating money. That means you hold through and even buy the intermediate term dips until a bear market signal is given.

Leave A Comment