It’s official: not only has bitcoin officially made its way to Wall Street, but confirming rumors that emerged over the weekend, “hedge” funds – starved of volatility in virtually all other asset classes – are now not only actively trading the volatile digital currency, but as clients of the vampire squid, have petitioned Goldman’s chief technician, Sheba Jafari to start covering it.

In the report that Goldman released this afternoon ago, Jafaru concludes that “the balance of signals are looking broadly heavy” with the following view: “wary of a near-term top ahead of 3,134. Consider re-establishing bullish exposure between 2,330 and no lower than 1,915.”

In other words, Goldman is bearish. Which probably means that bitcoin is set to make new all time highs shortly.

From today’s “GS Techs: Quick BTC“

Due to popular demand, it’s worth taking a quick look at Bitcoin here…

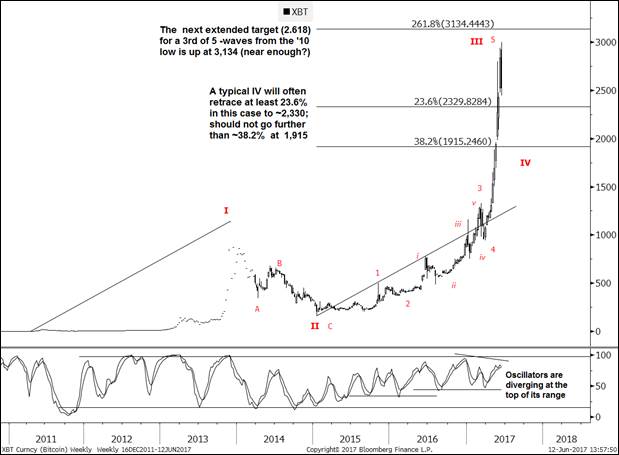

The market has come close (enough?) to reaching its extended (2.618) target for a 3rd of V-waves from the inception low at 3,134. It’s on track to forming a bearish key day reversal if today’s close settles below 2,749. It will also form a key week version if Friday’s close is below 2,475. Both daily/weekly oscillators are diverging negatively. All of this to say that the balance of signals are looking broadly heavy.

An eventual 4th wave should retrace at least 23.6% of the length of wave III, which in this case comes to to ~2,330. It shouldn’t go much further than 38.2% down at 1,915. Expect 4th waves to trade sideways/messy for a period of time before eventually continuing the underlying trend. Will use the length of wave I (~1,136 points up to the Nov. ’13 high) to measure the minimum projection target for wave V.

View: Wary of a near-term top ahead of 3,134. Consider re-establishing bullish exposure between 2,330 and no lower than 1,915.

Weekly Chart

Leave A Comment