Income investors have historically counted on utility stocks for reliable dividends. Duke Energy (DUK) has been one of the strongest dividend stocks among utilities. It has paid a dividend for 90 years.

Duke Energy is also a Dividend Achiever. These are companies that have raised their dividends for at least 10 years in a row.

You can see the entire list of all 273 Dividend Achievers here.

Duke has a very reliable business model. Going forward, it aims to boost its stability even further, by focusing nearly 100% of its business on regulated operations.

This is good news for the 4.5% dividend yield. Duke Energy may not be the most exciting stock, but it has a rock-solid dividend.

Business Overview

Duke Energy is an electric utility. It has a large regulated utility business that has approximately 7.4 million electric customers. Duke Energy’s customers are located in six states in the Southeast and Midwest.

It also distributes natural gas to more than 1.5 million customers in the Carolinas, Ohio, Kentucky and Tennessee.

The company operates in three segments:

Duke Energy’s Commercial Portfolio and International business segments operate power generation assets in North America and Latin America.

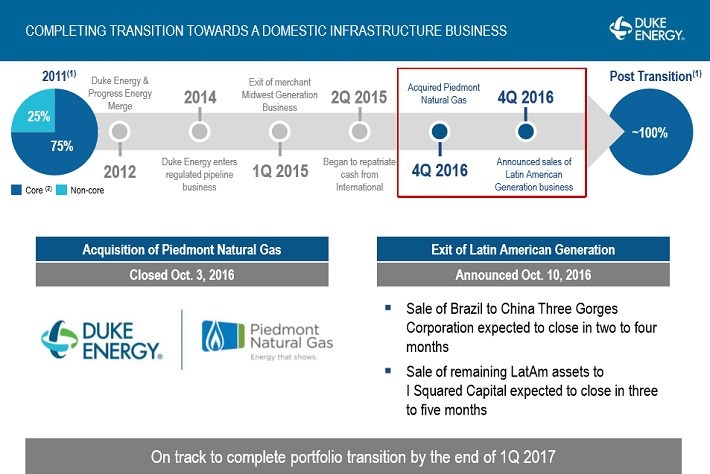

Duke Energy is a company in transition.

Source: Third quarter earnings presentation, page 4

The company has made a series of deals in an effort to focus on the regulated side of the business. First, it announced last year that it will be exiting its Duke Energy International subsidiary, due to the economic volatility in Brazil.

In addition, Duke Energy has turned to M&A. Last year, it purchased Piedmont Natural Gas for $4.9 billion. This expanded Duke Energy’s regulated exposure and tripled its natural gas customers.

Duke Energy also merged with Progress Energy in 2012 to further boost its regulated exposure.

As a result of these moves, the company has essentially exited from the Commercial Portfolio and International businesses. Duke will generate nearly 100% of future profit from its regulated business.

Leave A Comment