The headlines say the durable goods new orders declined and backlog shrunk. In addition, the unadjusted three month rolling average declined.

Analyst Opinion of the Durable Goods Situation

Our analysis is more negative than the headlines as the rolling averages declined. Civilian aircraft and defence spending were the main headwinds this month.This series has wide swings monthly so our primary metric is the unadjusted three month rolling average.

Econintersect Analysis:

unadjusted new orders growth decelerated 3.4 % (after accelerating 0.2 % the previous month) month-over-month , and is up 2.5 % year-over-year.

the three month rolling average for unadjusted new orders decelerated 0.7 % month-over-month, and up 4.7 % year-over-year.

Year-over-Year Change of 3 Month Rolling Average – Unadjusted (blue line) and Inflation Adjusted (red line)

z durable1.png

Inflation adjusted but otherwise unadjusted new orders are up 0.8 % year-over-year.

Backlog (unfilled orders) accelerated 0.02 % month-over-month, and is up 0.8 % year-over-year.

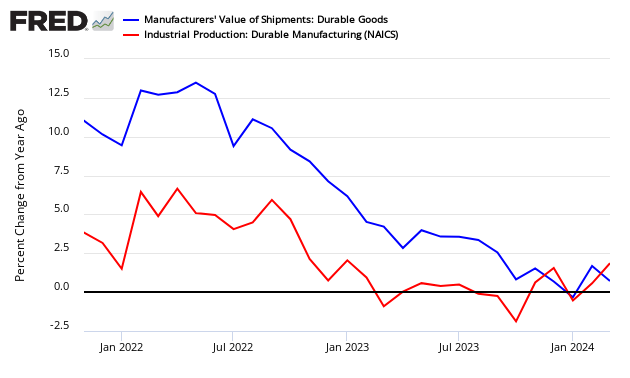

The Federal Reserve’s Durable Goods Industrial Production Index (seasonally adjusted) growth up 0.4% month-over-month, up 2.5 % year-over-year [note that this is a series with moderate backward revision – and it uses production as a pulse point (not new orders or shipments)] – three month trend is accelerating.

Comparing Seasonally Adjusted Durable Goods Shipments (blue line) to Industrial Production Durable Goods (red line)

note this is labelled as an advance report – however, backward revisions historically are relatively slight.

Census Headlines:

new ordersdecreased 1.2 % month-over-month.

backlog (unfilled orders) unchanged month-over-month.

the market expected (from Bloomberg/Econoday):

| |

Consensus Range |

Consensus |

Actual |

| New Orders – M/M change |

0.5 % to 1.6 % |

+0.5 % |

-1.2 % |

| Ex-transportation – M/M |

0.2 % to 0.7 % |

+0.5 % |

+0.4 % |

| Core capital goods – M/M change |

0.5 % to 0.7 % |

+0.6 % |

-0.5 % |

Leave A Comment