The headlines say the durable goods new orders improved. Our analysis shows the rolling averages improved.

Analyst Opinion of the Durable Goods Situation

Defense aircraft was the main tailwinds this month in the adjusted data. This series has wide swings monthly so our primary metric is the unadjusted three-month rolling average – which improved and is still growing faster than GDP.

Econintersect Analysis:

Year-over-Year Change of 3 Month Rolling Average – Unadjusted (blue line) and Inflation Adjusted (red line)

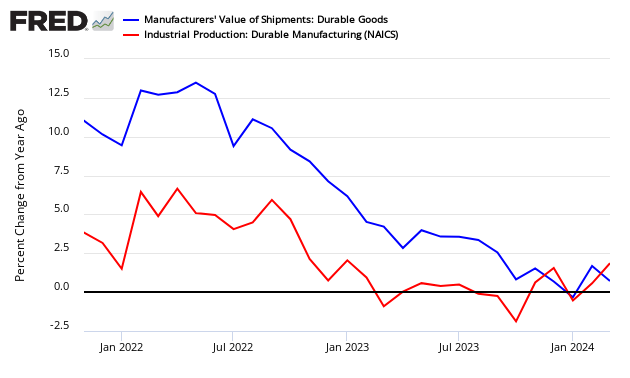

Comparing Seasonally Adjusted Durable Goods Shipments (blue line) to Industrial Production Durable Goods (red line)

note this is labeled as an advance report – however, backward revisions historically are relatively slight.

Census Headlines:

Durable Goods sector is the portion of the economy which provides products which have a utility over long periods of time before needing repurchase – like cars, refrigerators, and planes.

Econintersect concentrates on new orders as it is the entry point for future production – and somewhat intuitive economically.

Leave A Comment