Anything with a positive number and the mainstream will jump. The latest was durable goods which only featured a positive number in the seasonally-adjusted series. Still, it was enough to send out the usual notices that the worst is over even for manufacturing.

The U.S. manufacturing sector could be on the mend after struggling for the past year with a strong dollar, weak global demand and plunging commodity prices.

New orders for durable goods—manufactured products designed to last at least three years—rose in January following their worst annual performance since the recession. That improvement, alongside a pickup in a key gauge of business investment, could signal the sector may be preparing to turn a corner.

The bounce in new orders, following two straight months of declines, mostly served to recoup some of those losses. But the rebound in Thursday’s Commerce Department report comes against a backdrop of other improvement in the domestic economy including steady job gains, a firming housing market and resilient consumer spending.

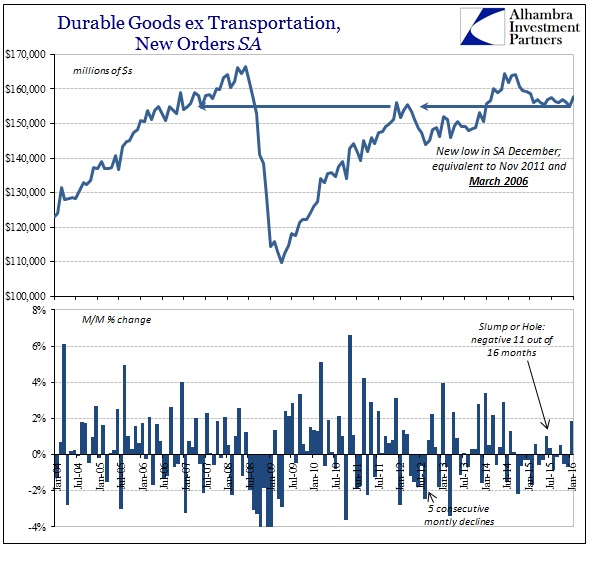

Maybe it’s the qualification “could” that saves the article from complete detachment, but actually examining the data (like “job gains” and that “resilient” consumer) leads to no such conclusion – not even close. The monthly increase in January in new orders was only in the adjusted set; in the unadjusted data there was no improvement to be found. Like retail sales, we are left to wonder how much was just calendar effects in the seasonal imputations. Even so, the adjusted estimate for January was still less than January 2015 along what is an alarmingly persistent trough (so far).

In the unadjusted data, the interpretations are much more serious. January’s estimate of $143.7 billion was slightly less than that of January 2013; it was 2.5% less than January 2014 and even 1.2% less than January 2007. There is nothing good to be said of any economic account that in 2016 can be unfavorably compared to the same month almost a decade and trillions in “stimulus” ago.

Leave A Comment