The rapid swings by so many formerly hot stocks (and even some cooler ones) has nothing to do with scatterbrained rotation as pundits claim; nor the Davos statements; nor what a beleaguered Fed said to defend their positions. The primary reason is because the market is dangerously illiquid. Pundits use all these factors; of course with a core of truth; to suggest that American companies would not be a bit disadvantaged or behaving poorly, if not for what the Fed has done.

What are the pundits missing? Mostly that they retroactively figure this out; and it’s at least a year after it became clear that an unending stimulative QE policy was deleterious to multinational earnings, margins, and our strong Dollar trend. What you have had is what we’ve described forthcoming for months: weakened strong Dollar killing big multinationals who can’t pass long currency exchange differentials; or must heavily cut export prices to compete at all; killing margins.

So now the pundits see the currency disconnect and balance sheet revaluation estimates ‘front-and-center’, so they can blame-away what’s happening (and is about to resume, perhaps with a vengeance) ‘as if’ the primary cause somehow is new, or unknown before yesterday’s Fed statement. Nonsense; the Fed sure knew they were late to the game of normalizing rates way earlier, as monetary policy shifts began with the tapering (and their flat-line balance sheet) early last year, as we contended. Along with that, the ‘recession’ that we said ideally will be tracked as starting about last July (with the secondary equity peak then; and the primary in the Spring of 2015 broadly speaking).

So of course all the explanations now have a nuance of validity; which is why a bit of foresight created at least an edge on lightening-up during 2015. Not just our urging of that; but a handful of astute money managers said the same; as I would point-out; and yes, because guys taking millions off the table on a steady basis last year, reinforced my confidence that I was on-track with slightly hidden agendas involved with the buybacks; and of course common sense regarding a greater impact on forward earnings and GDP numbers due to both currency as well as ‘competitive devaluations’ to which the Fed was NOT the key instigator.

That matters; because the oil supply increases; the cessation of hoarding by an overly aggressive China; commodities declines; and our forecast strong Dollar; all preceded anything the Fed did merely in recent months; but set-the-stage in a way we’ve consistently brought to investors attention (in case you missed any of it, because you’re newly aboard; well hopefully you saw it coming; and if not; be comforted to know there’s more downside ahead, and you also did not miss any major trend bottom last week; as that will be tested and ultimately broken).

In-sum: nothing has changed that we haven’t discussed. Slashing costs now is the latest ‘spin’ pundits are using to explain why the real economy is growing at the same time as the earnings were pressed. This is a slight distortion; goes to the heart of why average Americans are tired of spin about solid recovery as (if Apple said anything most accurate it was the statement about extreme variable conditions globally) they migrate to the two candidates that tell it like it is (with a vastly different approach to solving that aspect). So yes the Fed has hurt; but it has been evident for really a couple years that their ‘show’ would end badly.

This week we had varying earnings reports; and whether good or bad they get sold into generally (some keep partial gains; but not necessarily for very long). I suspect as pundits celebrate Facebook FB (which is still down for the month), or of course lament Amazon (we warned of buy rumor / sell news) while forgetting it invested a lot in ‘data storage’ products, which now have slower growth while it suppresses it’s margins in-order to finish-off the brick-and-mortal businesses to an extent. So I’m not worried about Amazon, but who would invest in stocks so advanced with slower returns over this year ahead? It’s over a year (remember we suggested avoiding Facebook’s IPO, but coming-in after ‘lock-up’ expired; a price level around 20 or just under) or so, when I expected a radical change to their advertising and messaging structures, making them more like full-fledged browsers; almost an operating system because of the messaging, video or mail capabilities. Did I suggest buying FB at 20; yes. Buy it now. Of course not.

Now I don’t usually comment much about individual stocks; we focus on overall market patterns. But this market is more bifurcated; and there are a handful of what I call ‘momo’ stocks without which the market can’t move. It’s similar to the normal requirement that 2 or 3 sectors (like housing, autos, financials or oil) all must be in-sync moving forward, in order to have a market advance. The newer group as you know is FANG – Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOG); and when the FANG’s are sketchy, along with the traditional sectors (ie: peak debt; peak oil; peak autos etc.), more weakness is coming. And it’s not all the dollar. And not all the Fed.

Behavior of FANG matters more than the other forms of retail or public stocks; while something like aerospace (Boeing BA in particular) are influenced by dollar shifts; a stock like EA (Electronic Arts) less so; though air-pockets abound. Oh, yesterday Intel (INTC) released the lower-end Skylake chips for sale to manufacturers, so add a new MacBook (maybe Pro) to Apple’s March WWD Conference (plus more). Time to invest? I think not. (Skylake is so far just in high-end 27″ iMac’s.)

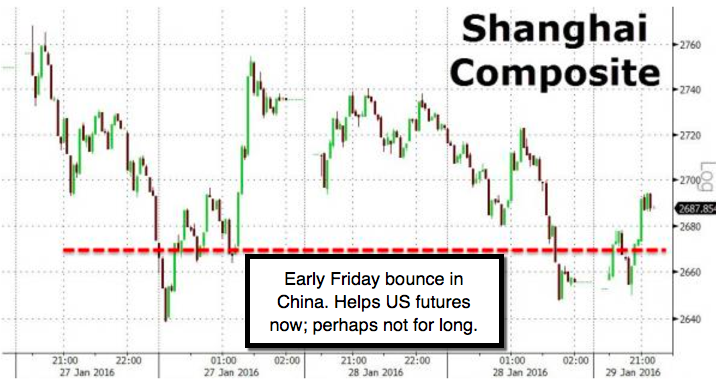

Bottom-line: analysis has not changed since 8 days ago we indicated that the rebound off the Wednesday washout from ‘Cash’ S&P 1812 would see another ‘battle of 1812’, but it would take perhaps as little as two weeks or into the start of February for the market to begin to really initiate a new decline that probes that level (whether tested, or bouncing around, or slicing right-through it) during the month ahead. Then we might (if it doesn’t flat-out crash, which is feasible) get a rebound, although lets not anticipate late Winter or Spring just yet.

(More follows, including one possibility that could foresee the next drop leading to a rally from lower levels.)

Leave A Comment