A great ‘moderation’ occurred – very much in-line with the intraweek forecast for a pattern that started to exhaust and even reverse, after an upward start on Thursday. Nothing dramatic, and sort of a see-saw move within a range; while nothing contradicts the idea of an oil-and-Dollar sensitive market somewhat in the wake of the sharp (and contrived from a last-ditch support) short-covering rebound; led by the most-shorted and the usual suspects for a rebound.

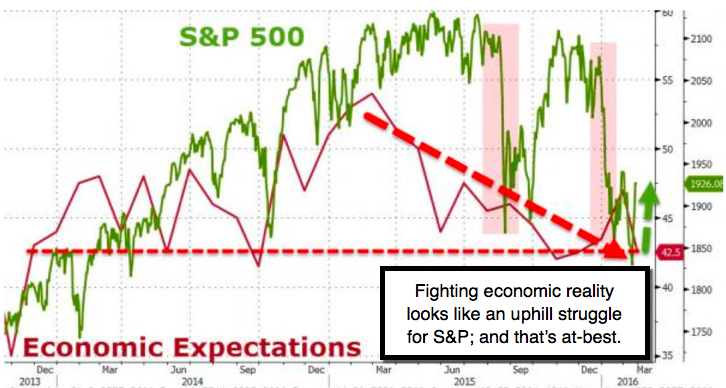

Technically, the S&P’s inability to surmount overhead resistance (not the first of the snapback peaks which is where we did encounter expected resistance); is a sign that this isn’t simply a ‘pause to refresh’, because they might well try one more time (at least) to push this higher. The point is we’re not among those that desperately are concerned about this, because they are overloaded on the long side, and ‘must’ determine whether they want to follow their own words as they generally got bearish a week or so ago; praying for a rally ‘to sell on’. Well here you are; and there’s no meaningful buy-side interest; with the longs holding-off somewhat, ‘as if’ they’re waiting for someone to come and push this higher.

Leave A Comment