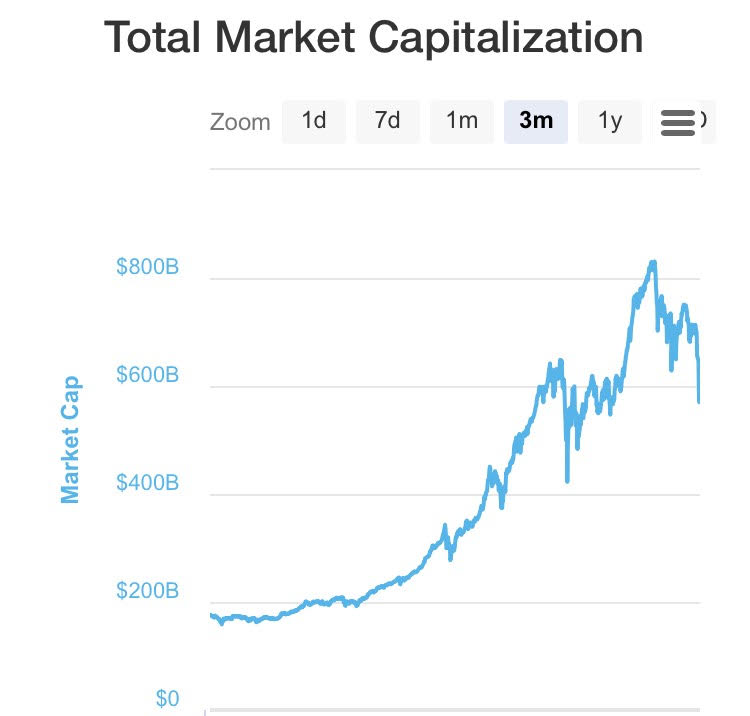

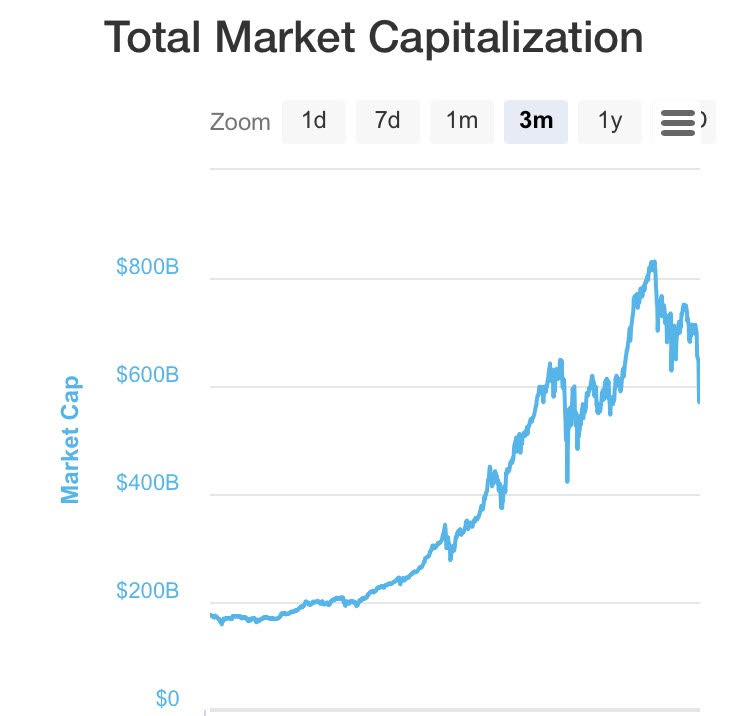

The cryptocurrency market suffered a major setback last night. In just a 24 hour window, CoinMarketCap.com data tells that the industry’s total valuation shrunk from over $700 billion to under $550 billion.

Of the top 100 coins as ranked by market cap, astonishingly all of them regressed during this time, save for just Tether (USDT), a currency tied directly to the US dollar. The impact on notable coins affected include Bitcoin (BTC) sinking below $12,000 for the first time since early December, Bitcoin Cash (BCH) dipping under the $2,000 mark, Ripple’s (XRP) price hitting a 3-week low under $1.30, and Ethereum (ETH) bottoming out at $1,000. Essentially no asset acted as a safe haven during the sell-off, with top coins seeing decreases as high as 40%.

Amidst all the downward activity, Bitcoin’s market dominance rose a few percentage points up to 36% as altcoin investors likely sold their smaller assets and moved capital into the market-leader to curtail larger losses. Bitcoin’s dominance had been hovering in the low 30% range after declining essentially non-stop for the past year due to a glut of alternative digital assets breaking into the cryptocurrency realm.

Many are chalking up the red numbers to the recent uncertainty accumulating in Asia, where regulatory pressure from Beijing and Seoul have somewhat halted global confidence on cryptocurrency integration. It’s likely, too, that many investors were taking profits during this stretch, as most of the industry’s assets had continued seeing major growth over the past month.

But while investors’ portfolios took a major hit, recent history might offer some optimism as to how it could rebound. Similar market losses that occurred around Christmas time, as well as multiple other market regressions in November, show that the historical response to such downturns has simply been more capital pumped in as a result.

Confident cryptocurrency investors are calling to buy the dips and still maintain that the industry hitting a $1 trillion market valuation is just around the corner. Those more skeptical view this development as a mere preview of what’s to come with the budding digital assets sector: an impending fatal collapse.

Leave A Comment