A Labor Department report of rising U.S. wages last week stoked inflation fears and touched off near panic in the global markets. The 10-year bond yield moved up sharply and equities underwent considerable volatility which seems to continue at a time of writing. But a deeper look at that report raises questions about whether wages and inflation really are rising to warrant concern that the fundamentals are changing.Last Friday’s jobs reports showed average hourly earnings for all private-sector workers increased 2.9% in January from a year earlier, the best gain since June 2009.

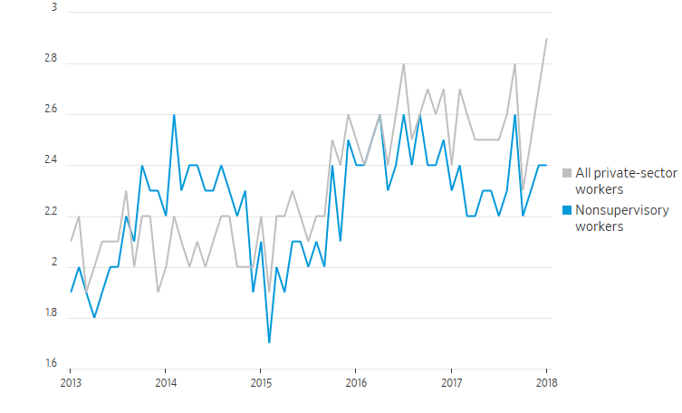

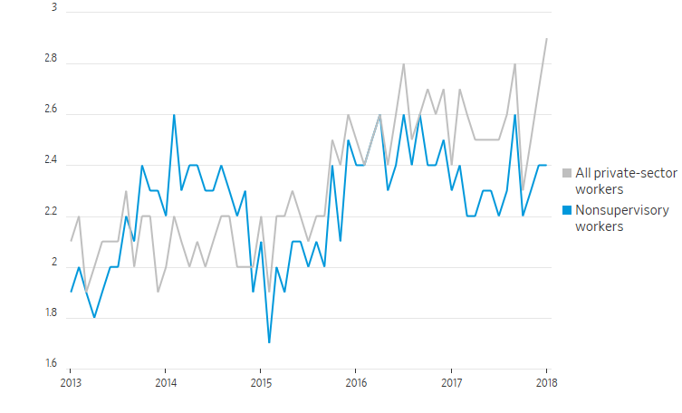

Just as not all workers are the same, not all wage increases are the same. Figure 1 measures the gains for all private sector workers and separates out non-supervisory workers who make up the bulk of the workforce. The latter recorded gains of 2.4% in contrast to the overall gain of 2.9%.

Figure 1 Wage Gains in the Private Sector

U.S. compensation costs make up about 70% of the total employment costs and provide for a better measure of costs facing corporations (Figure 2).Workers compensation increased 0.6 percent in the fourth quarter of 2017, in line with average results since 2015. Year-on-year, compensation costs for workers increased by 2.6 percent.

Figure 2 US Employment Costs

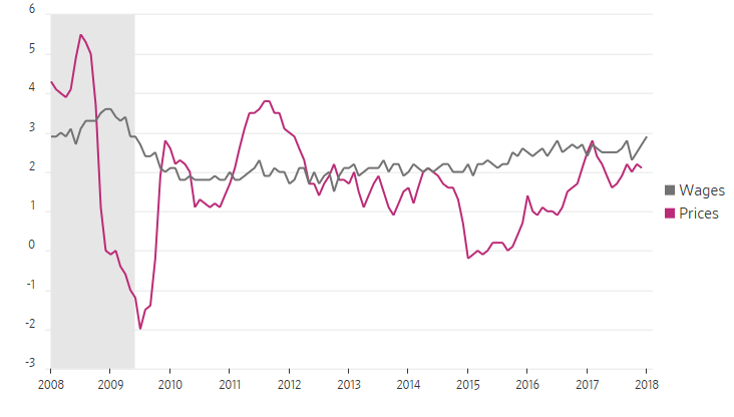

Turning to the inflation side of the issue, Fed officials continue to adhere to the Phillips curve which argues that the tighter labor markets leas to higher wages and ultimately to greater inflation. In this age of rapid technological innovation, the linkage between wage growth and inflation has clearly weakened. If nothing else, an uptick in wage rates does result in an immediate and direct impact on inflation. Figure 3 traces the behavior of wages and prices and does not support a strong, causal link. Wages movements (in either direction) have been relatively subdued while prices are much more volatile.

Figure 3 Wages and Prices

The financial markets seem to be gripped by a fear that inflation is rearing its ugly head. As well, the markets fear that central banks will withdraw much of the monetary support set in place since the 2008 crisis. It is not all clear that investors can assume that wages are about to accelerate leading to a higher rate of inflation.

Leave A Comment