Before I get right to the heart of the matter, as we look forward to the coming week that promises to be an eventful one as it includes midterm elections, let’s take a look back at the latest auto sales. For all the fears and consternation thrown about in the media and by analysts and economists alike, I felt it would be noteworthy given the latest U.S. auto sales reported.

U.S. Auto Sales

October auto sales came on the heels of a good showing in September, when hurricane-related replacement sales and Labor Day deals pushed sales higher. Based on reported results so far, October’s seasonally adjusted annual rate is tracking at 17.8 million to 18 million vehicles sold, analysts at Consumer Edge Research said. That would contrast with estimates of a seasonally adjusted rate of around 17.5 million for most auto-sales forecasters and a SAAR of 18.5 million in September.

Sales may not compare to last month’s “breakout” performance, but sales above 17 million for October would still be a milestone and mark just the fifth time the industry has reached that number. Here is what Jonathan Smoke, chief economist at Cox Automotive had to say about the latest auto sales data:

“Incentives, including numerous lease pull-ahead offers, are pulling in consumers who are feeling confident about the economy and the future,” he said. “The recent two-month trend is decidedly stronger than we’ve seen this year, and the improvement is not all explained by hurricane replacement demand.”

More importantly, even with the highest interest rate since 2009 of 6.2%, the rate is not keeping consumers away from buying autos. It’s just not happening as discussed in this video with CNBC’s Phil LeBeau.

S&P 500 Expected Move

October ended with a bang, but not before finding the S&P 500 (SPX) and Nasdaq (NDX) both falling into correction territory during the month. For the week that was, both the Dow (DJI) and the S&P 500 were up 2.4% and the Nasdaq advanced 2.7%, its first weekly gain since the end of September. Big tech earnings are now out of the way and unfortunately, most of FANG was found wanting for better guidance. Amazon (AMZN) and Alphabet (GOOGL) took it on the chin post-earnings, but have since bounced. Even in a tough tape on Friday, AMZN finished flat on the session, which may portend some “good tings to come Man”. (An attempt at a Caribbean accent).

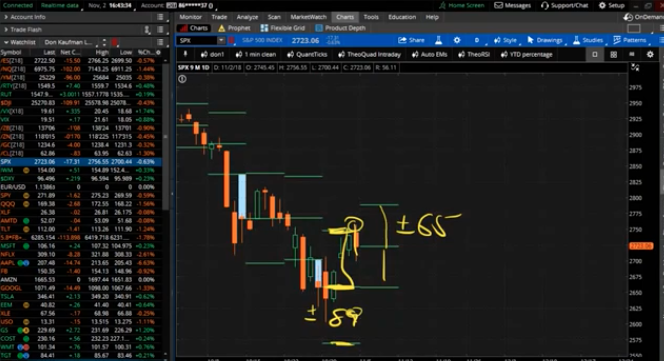

Last week’s expected move for the S&P 500 was some $90 and we captured every bit of that move and then some. But on Friday, with the market literally ripping in both directions at certain points during the day, ultimately the SPX gravitated right back toward the expected move and fell within it.

This coming week’s expected move is also lighter than that of the previous week at $65. With midterm elections on Tuesday, there is a greater possibility of the expected move being breached. When considering which end of the spectrum might be breached for the whole of the week, consider that buybacks are going to progressively increase with more than 60% of S&P 500 companies having reported already and the earnings picture is only accelerating to the upside.

Economic Data

From jobless claims to productivity growth to Nonfarm Payrolls, the data has been spectacular right? Headline alert, headline alert: The rapidly growing economy generated a sizzling 250,000 new jobs in October, keeping the unemployment rate at a 48-year low and pushing the increase in worker pay to the highest level in more than nine years. The headline NFP job growth number of 250,000 blew away economists expectations of roughly 190K or so. The amount of money the average employee earns rose 0.2% last month to $27.30 an hour, the government said Friday.

Leave A Comment