Japanese Negativity:

Apparently, the world of investors and economists were surprised of Japans (worlds third largest economy) recent decision to cut interest rates negative, except me.

It was not an “if” they would ever go negative, but a “when”, and it appears the time has come that many large economies embrace it (as previously written).

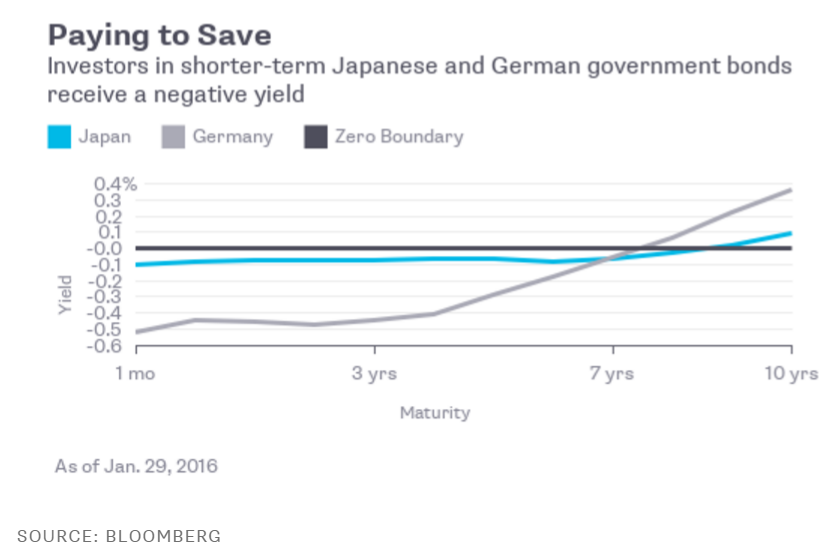

And as of the end of January 2015, there is a record $5.5 trillion of government bonds with negative yields. What was once a hypothetical,improbable, and dire situation is now reality for 1/4 of the index of government bonds. This means that investors for the first 7 years are literally not getting nothing, they’re paying:

Side note: what is absolutely necessary to explain is that simply a week before Japan adopted negative rates, Haruiko Kuroda had publicly RULED OUT the adoption of negative rates. In simpler terms, the man in charge of the third largest economies central bank shamelessly contradicted himself.

Bank of Japan Governor Haruhiko Kuroda said he is not thinking of adopting a negative interest rate policy now, signalling that any further monetary easing will likely take the form of an expansion of its current massive asset-buying programme.

Investors should ask themselves: what if Yellen does something similar? How would that affect portfolios? Wall Street is following every syllable that mutters as holy scripture, what if she suddenly changes course completely opposite of her stance now?

“The economy is recovering and growing at a steady pace, we can proceed lifting rates,” this sentence could suddenly become “The economy is floundering and we are reversing course and in fact going negative.”

Not likely? Well Japanese bond and equity investors and their countries savers/retirees/pensions learned the hard way. As I had discussed in previous articles: its not that these global central banks are run by unintelligent lying people, but that they cannot see what the future holds.

Leave A Comment