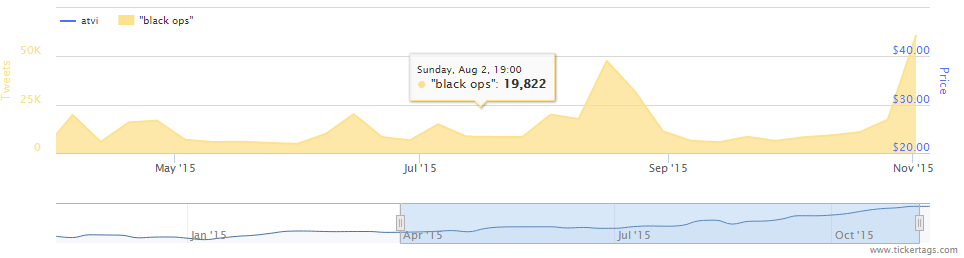

News that Activision (ATVI) released Call of Duty: Black Ops III sent search volumes, tags, and chatter on the game soaring on November 6. The interest in “black ops” is at highs not seen since August.

Shares of Activision are hardly reacting. The stock lost its positive momentum after announcing it would buy King Digital (KING) on November 3.

Source: https://www.tickertags.com

There is no doubt Call of Duty will bring in huge revenues for Activision. The positive cash flow from the franchise will support Activision’s mobile initiative along with integrating King Digital’s intellectual property. Still, there are short-term hiccups for the CoD title. Black Ops III has a PC issue whereby players cannot join an online match. PC users are also getting frame rate (performance) issues. The issue also happens for Sony (SNE) Play Station users and Microsoft (MSFT) Xbox One players.

Bugs may scare off would-be buyers, but in the longer term, game makers resolve the problems and sales continue rising regardless.

Beyond Activision’s core gaming revenue is mobile. Integrating the technology and creativity of King Digital will pose some risks for investors. It is easy to cut costs and find redundancies. The difficulty for Activision is applying Candy Crush’s stickiness and leveraging the massive user base. How will Activision advertise its games to the Candy Crush crowd? Will the minority of addicted, revenue-generating users pay for Activision’s mobile games, let alone install it?

For the time being, investors are holding onto Activision shares despite the uncertainty for growth in mobile.

Bottom line

Activision will benefit from seasonal strength, as users buy up titles during the holiday. Beyond that, the stock does not have upside surprises. The stock is up 92 percent from its yearly low, and just 7.6% down from its high.

Leave A Comment