The average scores across our universe of ADRs is 48.67 and that’s below the four week moving average score of 49.20 and above the eight week average score of 48.16. As a reminder, we shifted scores to reflect Q2 historical seasonality last week.

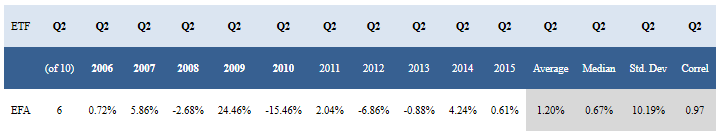

Over the past decade, the MSCI EAFE (EFA) has gained ground a coin-flip six times, producing a median 0.67% return. Typically, April is the EFAs best performing month of the quarter.

The following chart shows average historical monthly returns for the EFA by month.

The average stock in our ADR universe is trading -26.76% below its 52 week high, 3.6% above its 200 dma, has 3.61 days to cover held short, and is expected to grow its EPS by 17.7% next year.

The following are the top and bottom scoring ADRs.

Utilities (SBS, CPL, NGG, KEP, EOC), basic materials (SIM, CEO, SYT, BAK, YZC, SID, PBR, GOLD, PBR), services (CTRP, VLRS, UGP, OMAB, KOF, ICLR, HMIN, CPA, WNS, PAC, IHG, EDU), and technology (TU, NTT, IIJI, BIDU, GSOL, CMCM, CHU, WUBA, ERIC, TSM, LOGI, JST, JD, CHA) are the best scoring sectors across ADRs. Healthcare, industrial goods, financials, and consumer goods score below average and should be underweight in portfolios.

The best zones are No. America (BCE, TU, RY) and Latin America (VLRS, SBS, BAP, SIM, UGP, OMAB, KOF, CIB). No. America, Latin America, and North Asia (CTRP, NTT, IIJI, BIDU, CEO, CMCM, CHU, WUBA, HMIN) are the top scoring regions. Canada (BCE, TU, RY), Mexico (VLRS, SIM, OMAB, KOF, PAC), China (CTRP, BIDU, CEO, CMCM, CHU, WUBA, HMIN), Brazil (SBS, UGP, BAK, CPL, SID, PBR), and Taiwan (TSM, HIMX, SPIL) are the best countries.

Leave A Comment