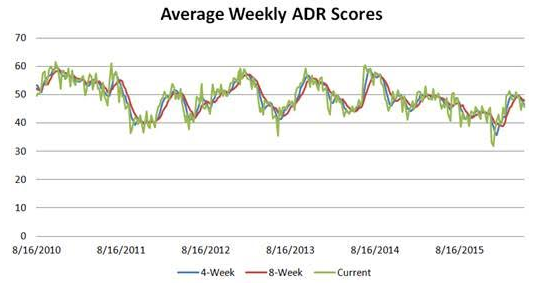

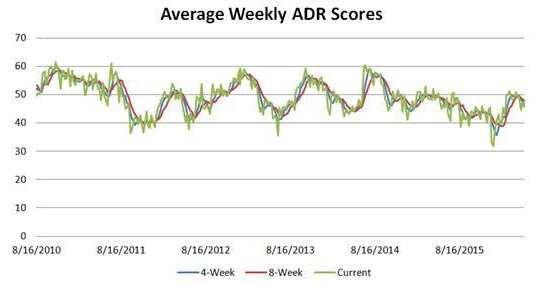

The average scores across our universe of ADRs is 45.64. For comparison, the average four and eight week ADR score is 46.67 and 48, respectively. The following chart shows historical scores since 2010.

The average ADR in our research slipped by 1.47% last week and is now -26.97% below its 52 week high and 0.46% above its 200 dma. The average ADR has 3.62 days to cover held short and is expected to grow its EPS by 13.46% next year.

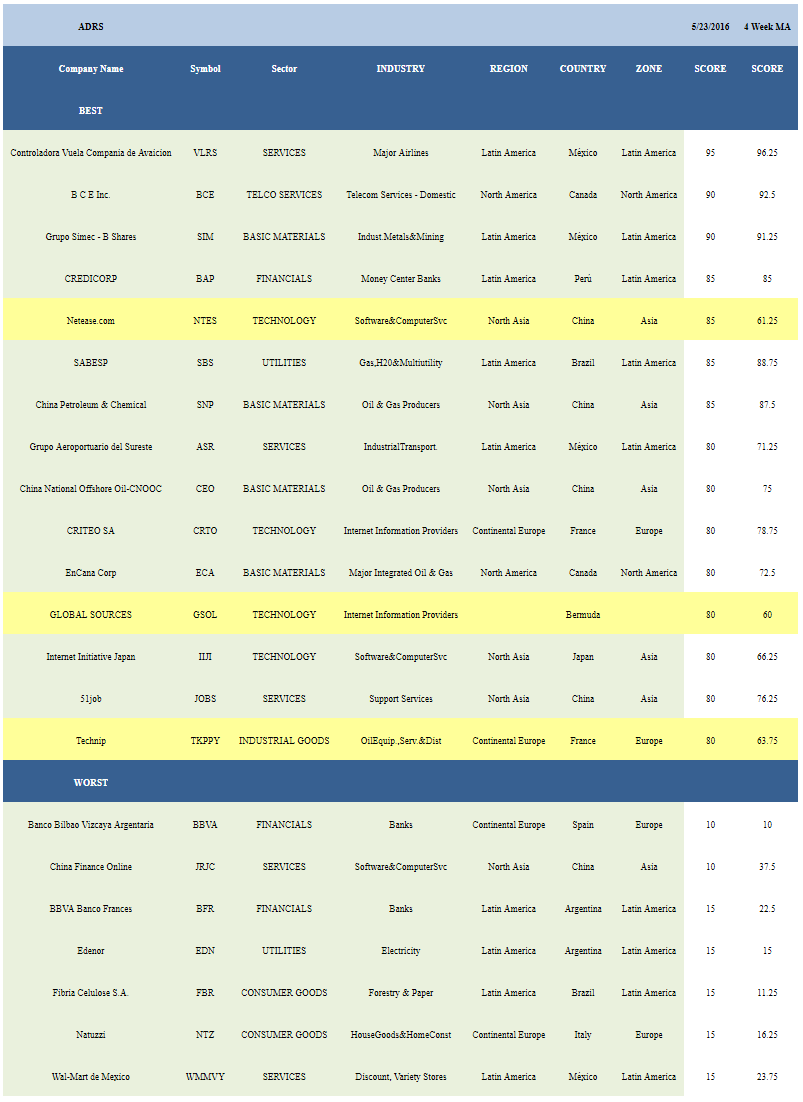

The next table highlights the best and worst scoring ADRs in our universe.

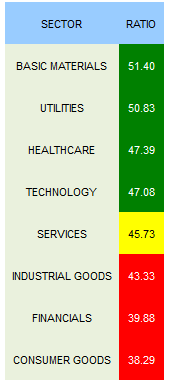

Basic materials (SIM, SNP, ECA, CEO, YPF, SUBCY) is the strongest scoring sector in our ADR universe. Utilities (SBS, CPL), healthcare (GWPH, FWP, GSK, GLPG, AZN), and technology (NTES, IIJI, GSOL, CRTO, TSM, PTNR) also score above average. Services score in line with the average universe score. Industrial goods, financials, and consumer goods score poorly.

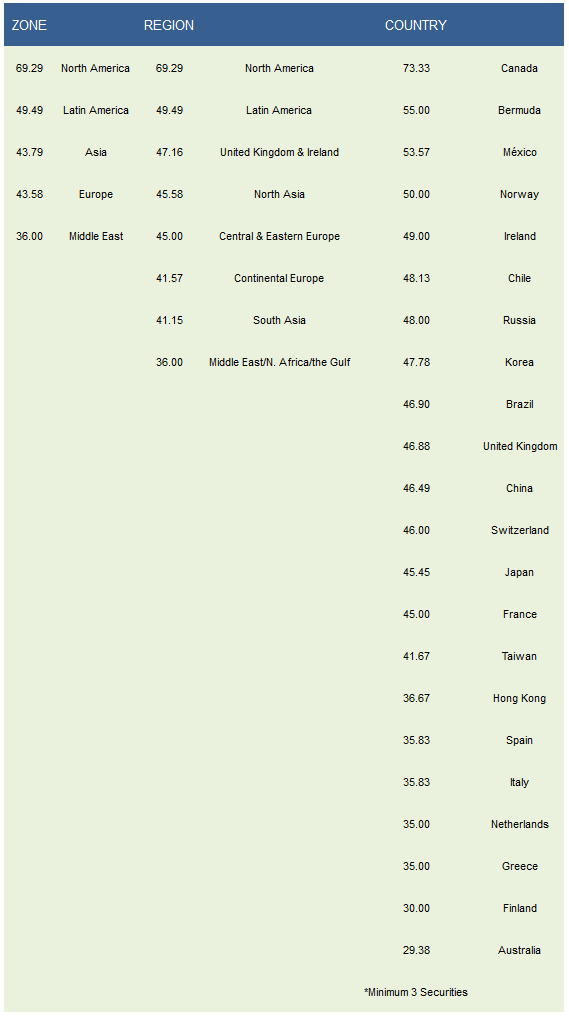

The top scoring zones across ADRs are No. America (BCE, ECA, RY, BMO) and Latin America (VLRS, SIM, SBS, BAP, ASR, UGP, OMAB, CIB, YPF). North America, Latin America, and UK/Ireland (GWPH, PSO, BP, NGG, VOD, BT, GSK, AZN, BTI) are the best regions. Canada (BCE, ECA), Bermuda (GSOL), Mexico (VLRS, SIM, ASR, OMAB), Norway (SUBCY, STO), and Ireland (RYAAY, ICLR) are the strongest scoring countries.

Leave A Comment