<< Read Part I: Bakken Update: Economics Improve As Costs Decrease And Enhanced Completions Improve Production

As part two of this series, we continue to look at production increases and cost cuts in the unconventional oil industry. This is not limited to any play, although economics is considered the best in the Permian and STACK. Cost decreases have been seen through better oil service contracts, including frac sand and fluids prices.Water costs are down, as water depots are not as busy and most operators have or are putting pipe in the ground.Operators continue to decrease drilling and completion times, while improving production. As efficiencies have improved, so has source rock stimulation.This is how the operator breaks or fracs the rock to release oil and natural gas. By doing this well, it increases production significantly. Operators are focusing on the best geology.Core operations produce more resource per foot. When coupled with better well designs performance increases.These are the reasons unconventional US well economics is improving. This is part of the reason the current oil glut has kept prices low for a very long time, and with it the US Oil ETF (USO).

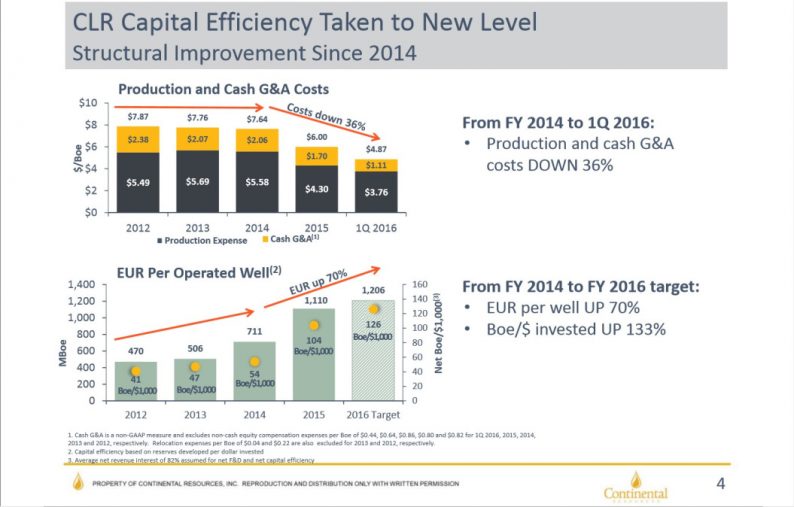

Continental (CLR) has seen cost improvements. Since 2014, production and cash G&A are down 36%. Over that same time frame, EURs are up 70%. EURs are not a great way to measure well productivity, but it does provide an estimate or starting point. Wells produce approximately half of resource in the first years.If EURs are up 70%, in theory the same could be said for the first five years of production. Some wells will outperform EURs over the first few years, while others lag.In CLR’s case, the improvements have been great.It has moved rigs to its core Bakken leasehold, and realized improvements through the STACK. By adding this Oklahoma acreage, it has provided a better core than North Dakota.

(Source: Continental)

CLR continues to improve production per dollar.Some of this is due to the STACK, but we are seeing better completions in North Dakota.EURs are up, but some of this is due to high-grading. If we look back to 2012, it is up over 300%.Well costs continue to improve.

(Source: Continental)

Bakken well costs have seen improvements.Although it is highlighted here, we have seen this throughout all plays.There was a time when one-mile laterals in the Bakken were around $10 million, but now most operators are doing it for a little more than half that.The above slide shows well costs on an average two-mile lateral.This is the North Dakota average.Operators have tried three mile laterals but it is too difficult to control the entire length.On average, an operator does produce more per foot doing a one-mile lateral, but has to bear the cost of drilling twice as many holes.Now CLR can drill and complete a location for approximately $6 million.

Leave A Comment