The average score for mid cap stocks in our universe is 59.36 and the average score over the past four weeks is 61.16. The average mid cap stock in our universe is trading -14.57% below its52 week high, 4.11% above its 200 dma, has 4.9 days to cover short, and is expected to grow EPS by 17.1% in the next year.

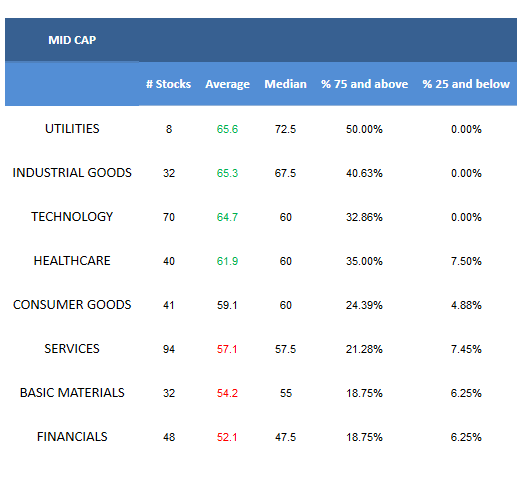

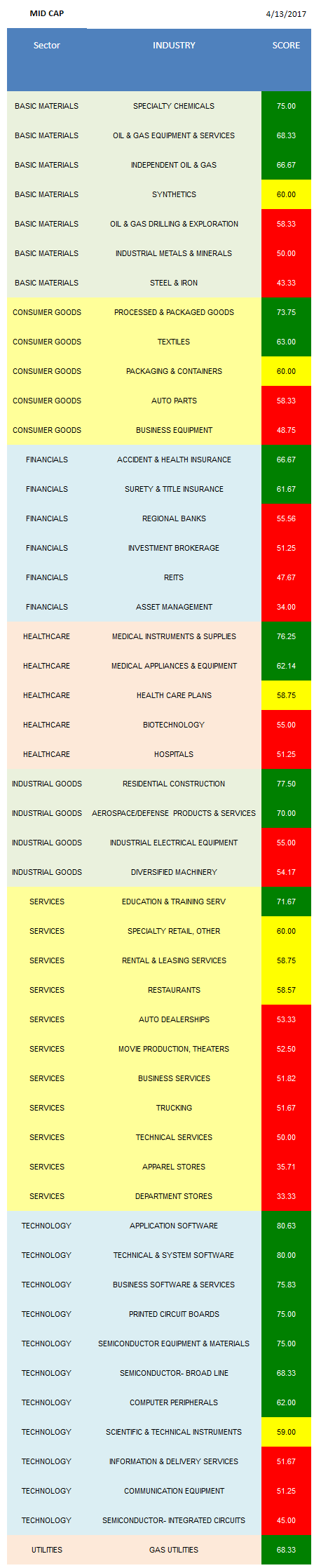

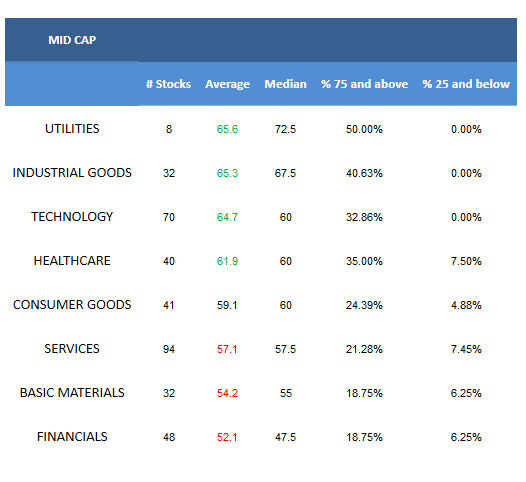

Utilities, industrial goods, technology, and healthcare score above average this week. Consumer goods score in line. Services, basics, and financials score below average.

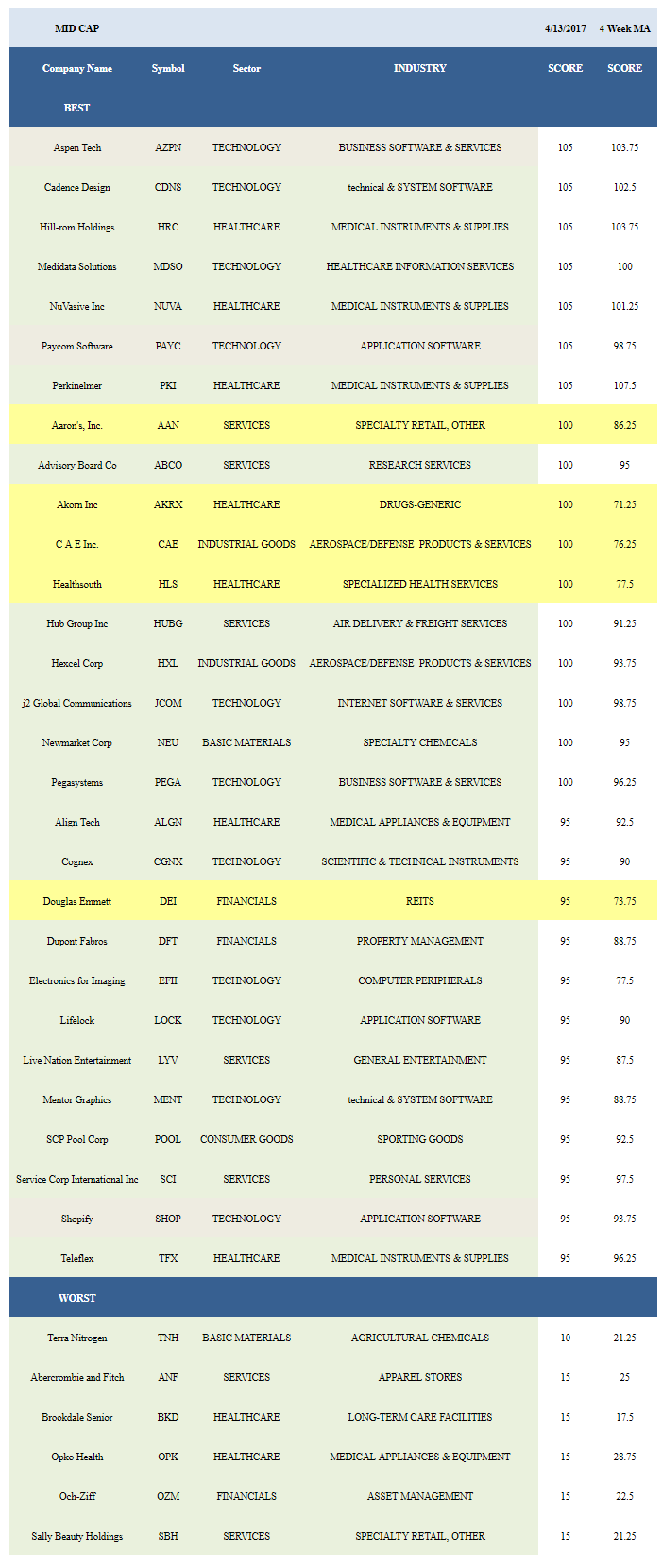

The following stocks score best and worst in mid cap.

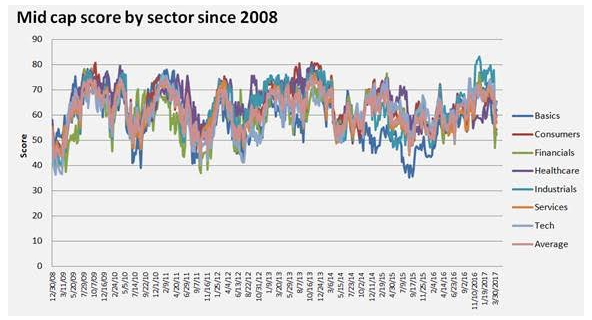

The following chart shows historical mid cap sector scores.

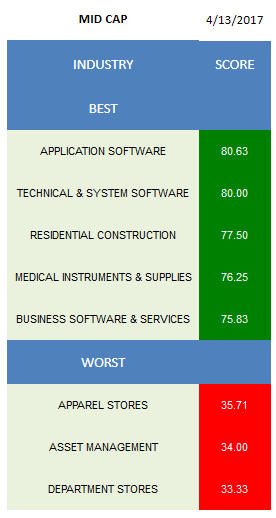

Application software (HUBS, PAYC, SHOP, LOCK, FTNT), technical & system software (CDNS, MENT), residential construction (KBH, NVR), medical instruments (PKI, NUVA, HRC, TFX), and business software (AZPN, PEGA) are the best mid cap industries.

Specialty chemicals (NEU), oil & gas equipment (RES, PDS), and independent oil & gas (RICE) are best in basics. In consumer, concentrate on processed & packaged goods (LNCE, FLO) and textiles (WWW). The top scoring financials industries are accident & health (CNO) and surety & title (AGO). Medical instruments and medical appliances (ALGN, GMED) are top scoring in healthcare. Residential construction and aerospace/defense (HXL, CAE) are high scoring in industrials. Concentrate on education (DV) in services.Application software, technical & system software, and business software are best in technology. Gas utilities (EGN) are also strong scoring.

Leave A Comment