Trading Strategy

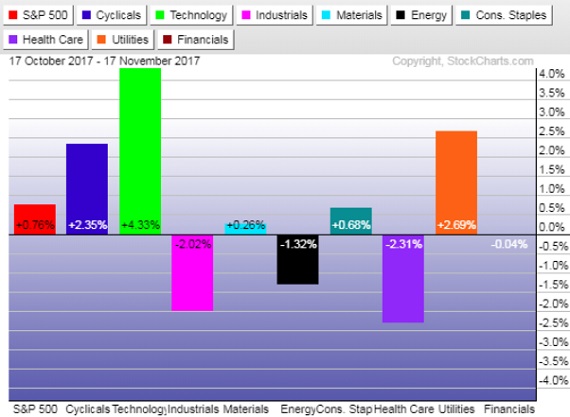

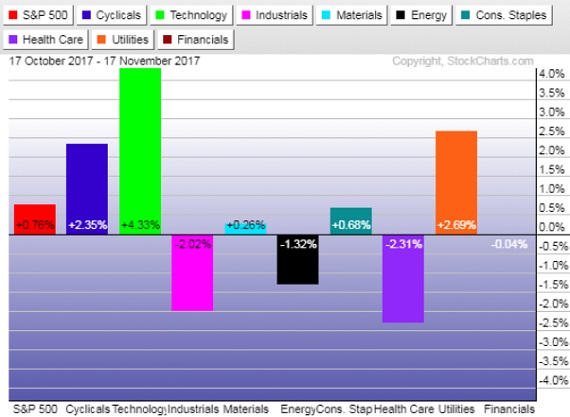

Patti Domm in CNBC believes that stocks have a good chance of trading higher in the week ahead, if the typical Thanksgiving holiday week trading patterns take over. The S&P 500 has averaged a gain of 0.6 percent during Thanksgiving week, and has been higher 75 percent of the time since 1945. In the years when the market is already up 10 percent or more, Thanksgiving week was even stronger — gaining nearly 0.8 percent on average, according to Bespoke. Last week we wrote “…Money managers continue to sit on more cash than they have in a very long time. As earnings season progresses investors are ‘selling the news’ at the current elevated prices and sitting on cash waiting to buy the next dip. Any weakness next week could be a good entry point for new longs ahead of the usually bullish Thanksgiving holiday…” Last Wednesday, the S&P 500 index closed below its rising 20-day Moving Average for the first time since Aug. 29. That is a long time above the 20-day MA, but falling below it after such a long time above it is not necessarily a sell signal, but the signal to “buy the dip”. And right on que stocks gapped higher the next day as investors immediately stepped up to buy the dip. The market is normally more subdued during Thanksgiving week. But just like what happened last week, expect algorithmic “buy” programs to automatically kick in when indexes breach support levels. In the updated graph below you can see the Technology sector surging the past month driven primarily by large tech shares. Utilities stocks are jumping in anticipation of the Fed raising rates at their meeting next month.

Leave A Comment