The investment thesis here is very similar to a covered call but with limited downside risk. If you are familiar with options you may know about the covered call strategy where you buy the stock and sell a call for every hundred shares at a strike price generally at or above the stock price and collect the call premium. With this contract, an investor needs to hold the stock (even as the price goes up or down) until the contract period and deliver the stock to call contract holder at the strike price if the stock goes above the strike price and keep the premium. The reward for the call seller (writer) is the call premium plus any additional profit if the strike price is above the strike price at option expiration.

But the risk involved in this strategy is that if the price falls below the strike price the investor cannot sell the stock unless he comes out of the contract. In theory, the option can lose all of its value. Potentially, a covered call can have limited upside but very high risk. However, in certain arbitrage scenarios, you can have good upside potential with limited risk.

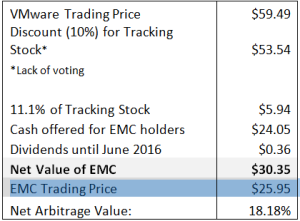

In early October computer maker Dell announced it will buy data storage company EMC (EMC) for $67 billion. Under the deal Dell is going to pay $24.05 cash per EMC share and 0.111 share of VMWare (VMW) tracking share. (EMC holds 81% of VMware). This tracking share closely resembles VMware stock except it will not have voting rights.

As of today EMC is trading at approximately $26 or $2 more than Dell’s offer price. However VMware is trading at $59.44; 11.1% of VMware value is $6.60, clearly there is an arbitrage opportunity is here. We took an even harder look at VMware and discounted its tracking by a whopping ten percent for lack of voting rights for the tracking shareholders and recalculated arbitrage value of $4.67 per share, or more than 18% upside potential.

If the merger between Dell and EMC happens in the next eight months then the annualized upside potential is 27.27%.

Leave A Comment