First I would like to apologize for the short Weekend Report today as it was a very busy day for me. I will have many more charts to show you tomorrow night as the markets will be closed.

The first chart I would like to show you is the short term $WTIC chart which shows the small H&S consolidation pattern in place. Last Tuesday it broke below the neckline and Friday it backtested the neckline from below at 29.66. The neckline is a very fine line in the sand in which I’ll use to exit the DWTI trade if the price action starts trading above it.

Below is the long term daily chart which shows the combo H&S / falling wedge consolidation pattern. As you can see the small H&S consolidation pattern on the daily chart above is the backtest to the bottom rail of the falling wedge / neckline.

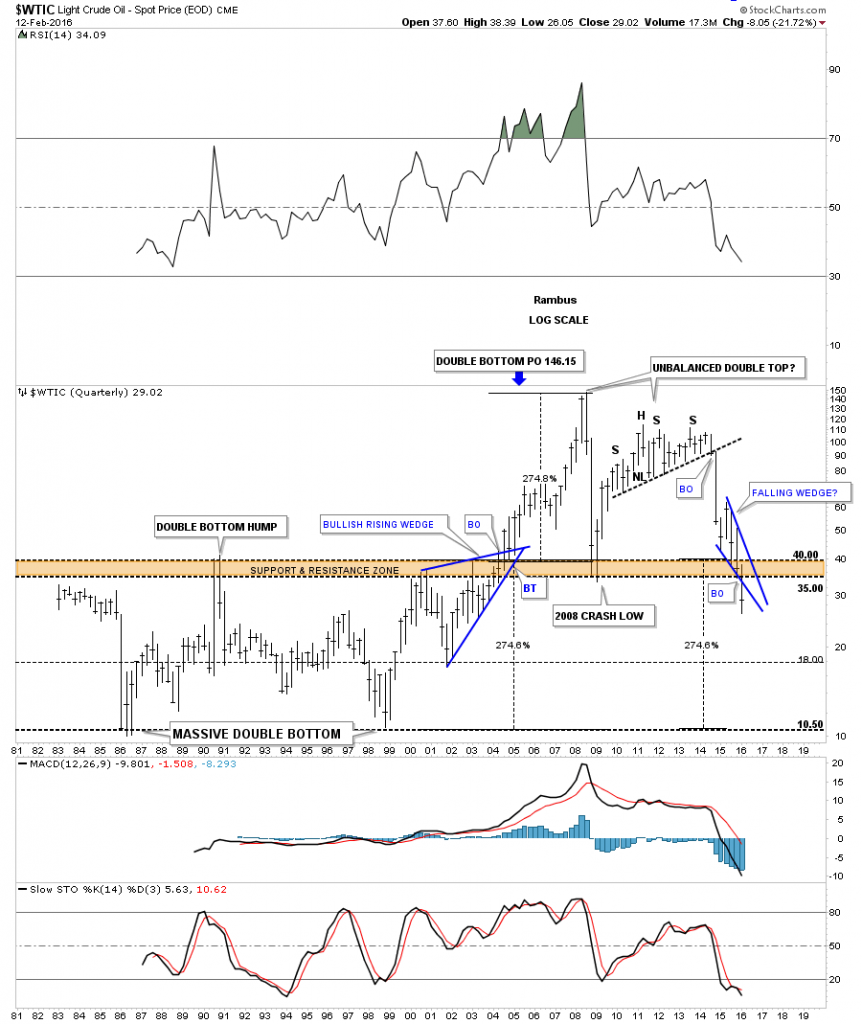

The long term quarterly chart for oil shows the reverse symmetry blue wedges that formed, one on the way up and our current one that has just broken down. It’s impossible to know if oil is going to reverse symmetry all the way down to the its all time lows around the 10.50 area but the possibility is there but hard to imagine.

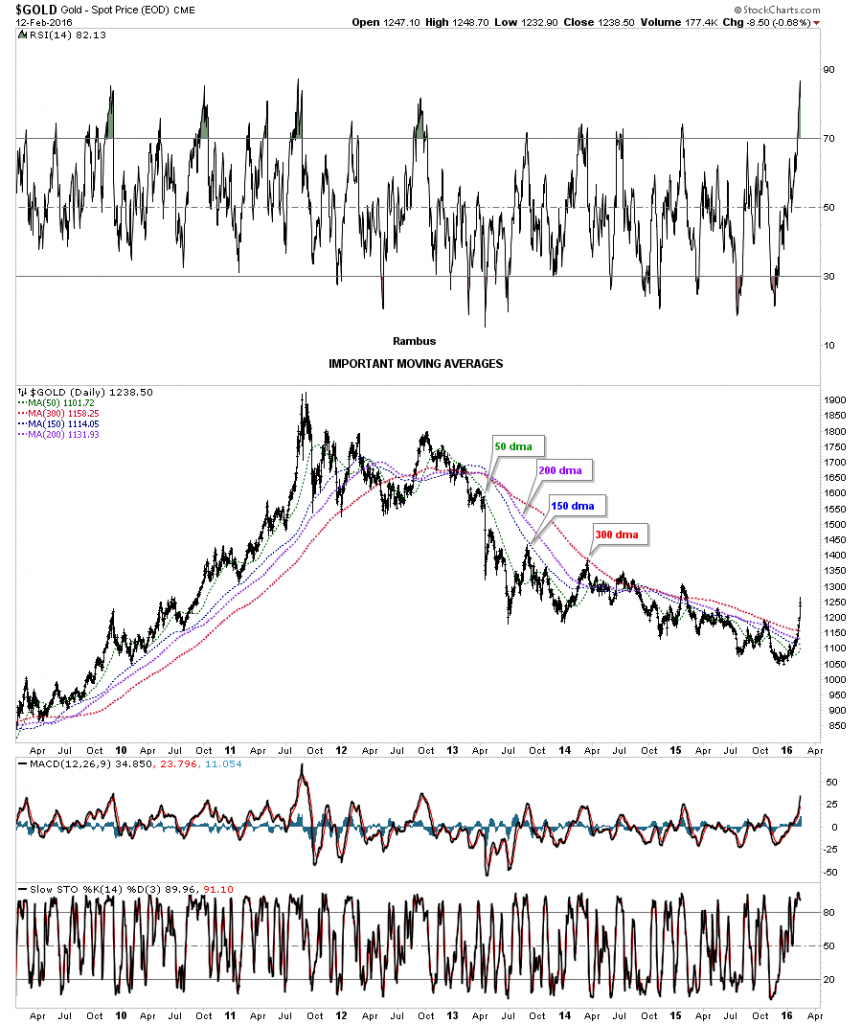

This next chart is the very long term daily chart for gold which is the all important moving averages chart we’ve been following. The last time I posted this chart gold it was still trading under the 150 day moving average I believe. I said at the time that gold would have to show its hand by trading above the 300 day moving average which it has done. It’s now trading at the highest point above the 300 day ma since the bear market really took off to the downside back in 2013. It now comes in at 1158 which is about 80 points lower. That’s a pretty substantial breakout above the 300 dma.

This next chart is a combo chart which focuses in on the HUI in the middle and gold on the bottom which we began watching last year. As you can see the last two weeks have made a dramatic impact on the HUI and gold charts. I still remember putting that question mark on the 9th reversal point on the gold chart thinking, is it going to put in another reversal point to the upside, as I was thinking the falling wedge was finally going to break to the downside. The charts don’t care what I think as gold broke to the upside last week.

Leave A Comment