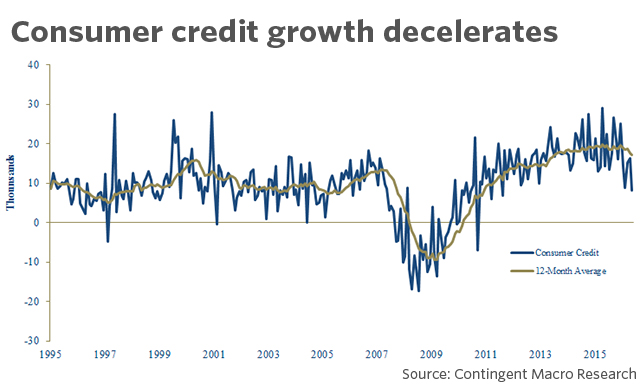

Yesterday, the Federal Reserve released the April Consumer credit growth data. It was another splash of cold water in the face of the “Trump Reflation” school. Consumer credit growth horribly missed expectations by economists. April only saw growth of $8.2 billion compared to an expected growth of $17 billion. This was 50% below their estimates and far below March’s revised $19.5 billion in credit growth. . .

The main source of credit growth, non-revolving credit, which covers loans for education and cars, slowed sharply in April. This category rose at a tepid annual rate of 2.9% in April, which was also the slowest pace since August 2011 – MarketWatch

This is the slowest increase of consumer credit in the last 6 years.

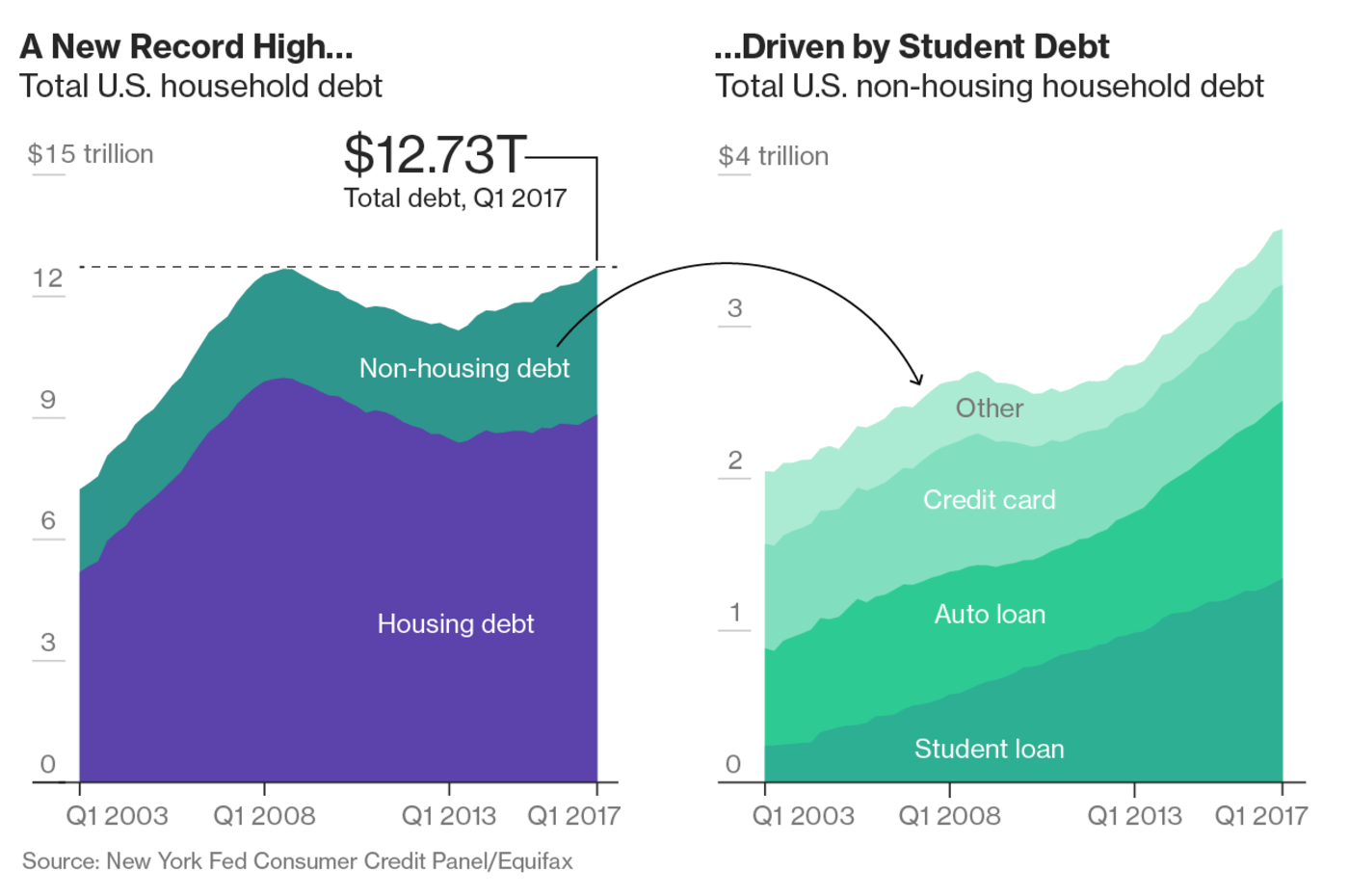

After a disappointing Q1/2017, economists were hoping for a second quarter rebound in spending. The United States is a consumption based economy and roughly 70% of economic growth stems from consumer spending. With the average American consumer already choking on debt, it is looking like that they can’t continue borrowing more to consumer more.

As highlighted last week, the Commercial and Industrial (C & I) Loans market is signaling growing concerns. A tightening Fed is only putting individuals under greater stress. Since 2009, borrowers have been addicted to the notion of simply refinancing their debt to get lower payments, but with interest rates rising, many won’t be able to keep doing that. Unless asset prices continue to rise or real wages make miraculous year-over-year growth, consumers are left far more vulnerable to any minor financial hiccups.

A survey by UBS Group AG found that the pain may spread to other loan types. In the first quarter, 17 percent of U.S. consumers said they were likely to default on a loan payment over the next year, up from 12 percent in the third quarter, before the election, wrote strategists Matthew Mish and Stephen Caprio.

The percentage of debt that’s at least 90 days delinquent rose to 3.37 percent in the first quarter, the second consecutive quarterly gain, according to data from the New York Fed. It’s the first time those delinquency figures have risen twice in a row since the end of 2009 and beginning of 2010 – Bloomberg

Leave A Comment