The American economy is particularly strong this year and the job market is virtually fully employed.

Adding to the range of the potential concerns over increasing inflation, the U.S. dollar has been unusually weak, which also tends to stoke inflation.

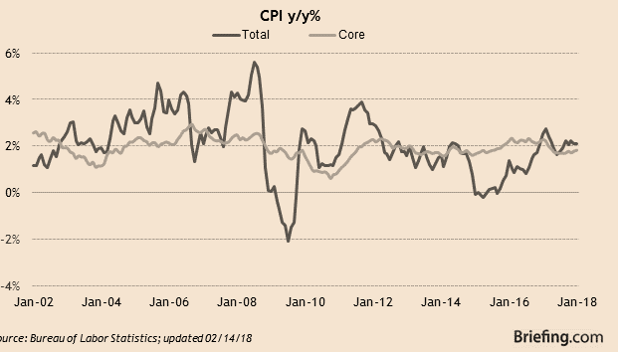

Nonetheless, a glance at the following chart suggests that inflation rate has been rather stable at around a 2% annual rate, whether one focuses on core inflation or the headline CPI.

The total CPI increased 0.5% in January over the previous month, while the core measure, which excludes food and energy, rose 0.3%. Indeed, as of January 2018, the total CPI had risen by 2.1% over the past twelve months, while the core price increase was up 1.8%.

In other words, based on these recent price trends, one doesn’t really get a sense of consumer prices taking off.

Unfortunately, the 0.5% increase in the CPI in January does not really alter the expectation that the Federal Reserve will likely raise interest rates at least three times this year.

These rather benign inflation numbers will likely not calm the volatile equity markets.

Leave A Comment