Another eventful couple of weeks have passed, and I think we can all agree that everyone now has a clear understanding of where we are with respect to the economic policy being pursued by the US Federal Reserve. Oh no hold on, that’s the alternate world. In this one investors are going bald from all the head scratching – in a way it is lucky we all bit our nails down to stubs in the run up to the announcement.

In a recent article I wrote, my opinion was that the Fed would not raise rates and gold would rally in the wake of the announcement. That expectation played out well and gold moved higher briefly hitting $1156, but now that we have moved through my primary support region at 1114-1122, I feel there is a chance we head back to the lows. A nice bullish short term trade but nothing more than that.

One of the big talking points in my trading room this week was the reaction and subsequent performance of the US Dollar (UUP) in the days following the decision to abort ‘liftoff’. Given that a number of Fed officials gave tacit consent to delay a hike into 2016, many expected the dollar to head back to the 90/91 level, but instead the dollar held the ideal support region on my chart (94.1-94.6) and has since blasted off to the upside.

I believe there is good reason for that strong dollar performance, and I believe it will influence our gold rally in the next few weeks, but before I come on to that topic I thought it might be useful to review the daily chart and answer a question I have been asked a lot recently:

Has Gold Made The Low?

It will probably sound stupid to say this (bear with me for a few paragraphs) but that is not the question you should be asking at this stage – a better question if you are itching to buy gold and the gold miners is whether or not gold is in an uptrend or a downtrend, since you should only really look to buy when an uptrend is confirmed. Why risk your investing capital until you know it is safe to do so?

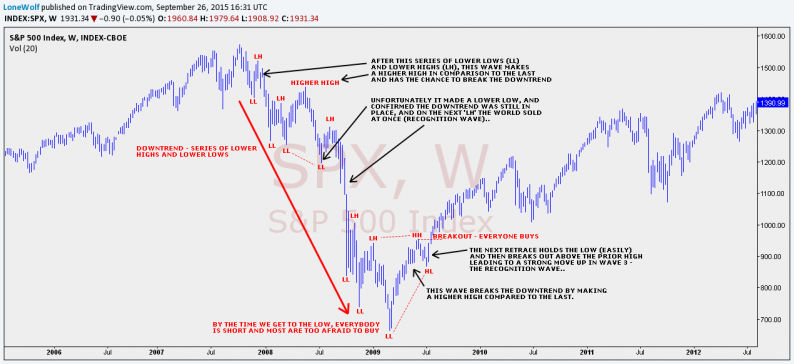

Since an uptrend is defined as a series of higher lows and higher highs, you first need to see a higher high on the daily chart and if the subsequent retracement holds the previous low only then do you have the chance of confirming the change in trend. You can see this concept on many charts but I have produced an example focusing on the S&P500 during the 2008 crash and subsequent 2009 bear market low:

Now contrast that with a chart of GLD and ask yourself if we are in an uptrend or downtrend. Is it wise to risk your long term investment capital just yet? What would we need to see in order to confirm the low in place?

Now don’t get me wrong, we all want to buy the exact low and make as much return as possible when the bear market in gold ends and the bull market resumes, but it would be prudent to look for evidence of trend change if you are an investor wishing to put your capital to work safely. You won’t miss out on much by waiting for that ‘higher low’ to form and buying the breakout.

Leave A Comment