For starters; one cannot say the market can’t lift-off a contrived double-bottom; even if it’s obvious the non-oil-story rumor was inserted at the precise moment a further breakdown (of oil or the S&P) would have resulted in a new purge last Thursday. In fact, the ensuing OPEC / Russia / Venezuelan ‘deal’ to ‘restrict’ oil production to current levels is actually the opposite of last week’s rumor; which was of a ‘production cut’, which is not what subsequently happened. So what’s the basis of the S&P move? Nothing really; just short-covering and a relief rally that we actually allowed for anyway for a different reason: lack of willingness to be (scalping basis) short in-front of ‘any’ Fed Chairman Capitol Hill testimony.

And the irony is they couldn’t get the critical-level relief-rally going based upon a word from Chair Yellen; as her implied remarks (the next day contradicted by a probably-perturbed NY Fed President Dudley) on ‘negative interest rates’, or NIRP, were entirely counter-productive and pointed to realization since 2010 of a Nation involved in a (then prospective) very sluggish recovery. Nevertheless someone ‘fed’ the Wall St. Journal a story from the UAE which wasn’t vetted in any form; but they ran with it; curiously at just the last possible moment. (Then the retraction later barely got financial outlets to say there was ‘confusion’ as to whether it was a deal or not. Of course it was not.)

Oil traders, not just S&P players hungry for a rebound, were super-pleased. Of course a funny thing happened today (Tuesday); and that’s no oil rally. That’s because even ‘if’ you get flat production agreed to; that’s not progress; that’s a step more towards increased production since most producing countries cheat. And that’s why WTI was actually down a bit while the S&P move up solo-walk.

The solo-walk extended to currencies; as China slipped after initially supporting as Japan tapered-off a bit. No encouraging economic news from Asia either; as China continues moribund while their debt bubble continues ballooning. Now of course I don’t see all this is immediately or even eventually cataclysmic as lots of super-bears do; but I don’t see anything particularly endearing to the bulls in a fundamental sense. The earnings-recession continues.

Bottom-line: very little has changed; almost nothing fundamentally. Oil might be a risk to the upside, but not much to the downside. If they can’t take oil up now; can they take it down? Probably, but not by much. If a blow-up happens say in the Middle East to curtail a supply source; would that rally Oil and thus initially take the S&P higher with it, with Oil stocks doing better than today’s meager bit of a rally? Yes; that’s a possibility; but there’s no way of predicting exactly that, and if Oil moved up now, because of a wider war rather than attempted hostility abatement, that would only temporarily assist equities.

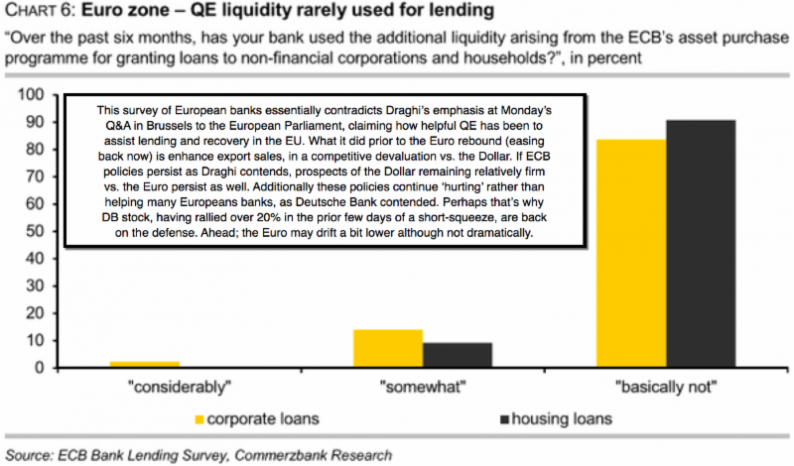

The PBOC is out there proclaiming defense of the Yuan; and Mario Draghi was out in full-force testifying to the European Parliament Monday about how much QE helped Europe (although it didn’t do much; currency declines did more of it) recover. If there’s a European meeting to be concerned about, it’s the Security Meeting in Brussels, which Frau Merkel will attend, and try defending her open door policy to migrants, which has already triggered a fragmented response by EU members. With Europe on the cusp of another stage of the migrant invasion as Hungary’s Prime Minister calls it, and the broad proclamation months ago of a ‘deal’ for a unified European response and policy by the time Spring arrives; it can’t go unnoticed that they have nothing approximating that.

A failure now by leadership countries of the EU risks a return to the chaos they promised would not be permitted. So you have various alternatives. We won’t delve into all that but will say Europe has not come together or worked-out an adequate plan with Jordan and Turkey pending stabilization in Syria or Iraq (or all the other nations that have taken advantage of the lax security situation for an opportunity to let refugees ‘have a go’ at making it to Europe). Moving NATO warships into the Agean to contain it is one step; but that’s not a real solution. It will turn into more of a rescue mission; and at least fewer will drown. Is this all a pathetic reflection on the situation? Of course, but it is the situation.

On-top of this; European banks are no more stable today than last week. What has happened is that Draghi and particularly German officials have addressed a slew of questions about the system and Deutsche Bank; and that means after the initial reaction (which was to rebound about a third of the preceding loss); a lot of citizens only now are thinking about the safety of their institutions; hence a backslide we saw today. And a resurgence of the Dollar accompanied that. if the Canadian Dollar was a small part of the Index, it would be even firmer. (As a for-instance, condo sales in Calgary are off about 40% this year; while over in Vancouver, benefiting from Chinese money fleeing Asia, prices are sky-high. A Canada dependent on oil and timber is definitely stressed by all this.)

In sum: the market move is concentrated in most-shorted and the momentum stocks (often the same) as you might suspect. The softer Oil and firmer Dollar, along with retreating Gold (for now probably on a sudden reversal by Goldman from recommending it at the end of the recent run; and 5 days later suggesting shorting it being a temporary factor) combine to allow this to be more than just a dead-cat bounce in the S&P; but not necessarily much more.

Because so many analysts got bearish ‘after’ the recent decline; you had what does qualify as a washout ‘of sorts’. The two-day turnaround rallied hard, and was concentrated as noted in the most-shorted of course. And they pushed into Apple (AAPL), ignoring Carl Icahn having sold millions of shares (no idea of price levels he did that; but the filing was reported today). It’s a classic short-squeeze right where they needed to; at a time (last week) where we thought one had to be on guard for a rebound (too much bearishness into weakness) for another reason (Yellen, who turned out to be a market negative). Confusing? Of course it is.

So maybe that’s a point, if nothing’s really changed but momentary psychology that allows bulls to be trotted-out to again proclaim where everyone should buy, it’s reeks of false rally (especially absent Fed wind at the market’s back like last year’s rebound). But most pundits ‘do’ see that and say fade the rally. This that actually helps it work a little higher. We’ll tackle that momentarily.

Leave A Comment