Soft drink sales in the United States fell for the eleventh straight year in 2015 and recent results from Coca-Cola (KO) and Pepsi (PEP) would certainly support the shrinking soda market. Nevertheless, there is one smaller competitor that is seeing growth across several of it’s well known brands. Dr. Pepper Snapple (DPS), the third largest soft drink company in the U.S., is seeing market volume growth that has pushed their market share to 18% vs 27% for Pepsi.

On April 27th, the company reported Q1 EPS of $0.94 vs the Wall Street consensus estimate of $0.86 on revenue of $1.49B, up 2.5% from the year ago quarter. 7UP and Sunkist brands were a laggard, but Schweppes, Crush, and Dr. Pepper saw a sales increase of 10%, 6%, and 4%, respectively. While the latter notable brands posted gains, they pale in comparison to a 22% spike in water sales (primarily from the Deja Blue and Penafiel brands). Looking outside of the homeland, currency volatility dampened sales by 2%, but central America continues to be an area of strength.

Following the solid first quarter results, S&P Capital IQ upped their 12-month price target to $108 from $104. This would put the price to earnings ratio close to 23x, which is comparable to the rest of the industry.

Shares of Dr. Pepper Snapple trade at a P/E ratio of 20.18x (2017 estimates), price to sales ratio of 2.83x, and a price to book ratio of 8.17x. Annual earnings growth is in the 8-9% range as top line growth holds firm between 2 and 3%, both of which support the company’s 2.2%+ dividend.

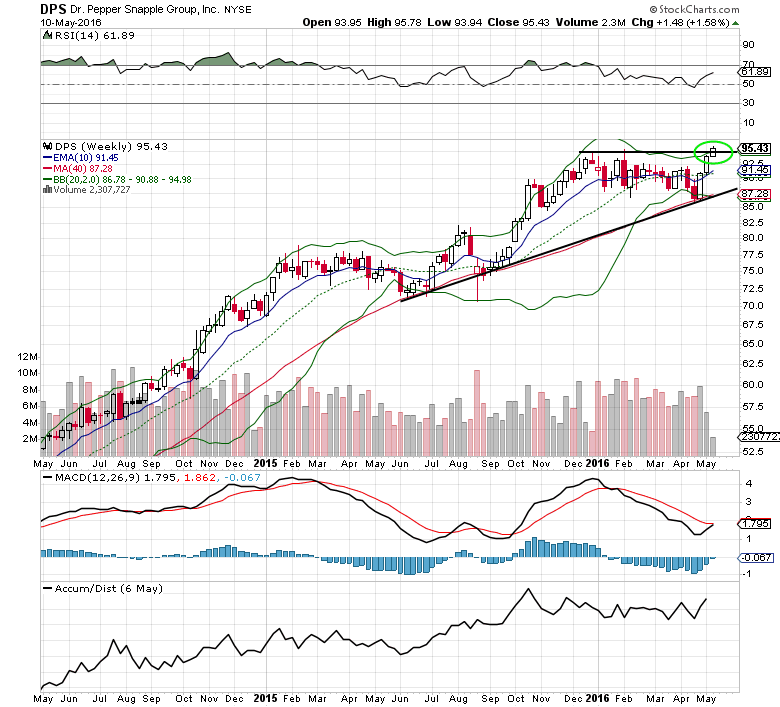

Looking at the 2-year weekly chart above, DPS shares are starting to break out above a multi-month ascending triangle. Closing above the $95 level on a weekly basis would negate the late 2015/early 2016 selling we saw at this same level. If the momentum can keep up it would position for a continuation to the $104-$105 area on a measured move basis (in-line with the fundamental projections). Consider using a stop loss in the low $90’s, high $80’s for long stock positions or for those experienced in options, buying the August $95 calls offer a favorable risk/reward ratio through the summer.

Leave A Comment