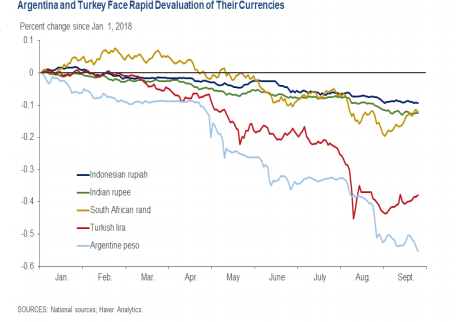

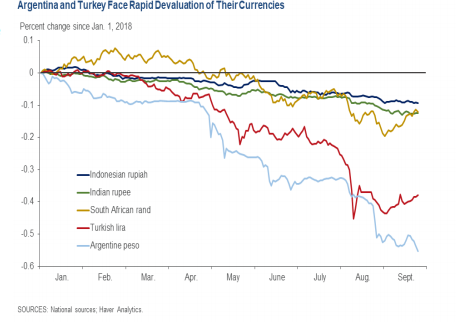

Emerging market currencies have not had it easy this year, particularly since the US dollar has been so strong.

Since the beginning of the year the Argentine peso has depreciated about 55% against the US dollar, while the Turkish lira has fallen about 40%.

As a report by the Federal Reserve Bank of Dallas (Oct.3) indicates, the common element among emerging market country devaluations are high levels of foreign debt and relatively low levels of foreign exchange reserves.

Countries such South Africa, Indonesia and India, which also have elevated foreign debts and inadequate levels of foreign exchange, have similarly experienced currency declines over the past few months.

Argentina and Turkey were forced to respond to their respective currency crises with interest rate hikes. Argentina’s central bank raised its policy rate 15 percentage points, and Turkey increased its rate 6.25 percentage points.

Leave A Comment