If ever the United States needs to rely on the kindness of strangers, it is now while it runs twin deficits. The trade deficit has been widening as exports weaken and imports rise in response to the strong U.S. dollar. The resulting current deficit cuts into GDP growth. The proposed ramping up of fiscal stimulus programs is expected to increase the federal government’s budget deficit. With both deficits likely to deteriorate further this year, the Trump administration could not have chosen a worst time to antagonize its major trading partners. These partners, collectively, will be called upon to finance these deficits.In a sense, the administration has picked a fight with its bankers, something smart business people avoid at all costs.

The Trade Deficit

The United States runs trade deficits with nearly 100 countries (Chart 1). As the world’s main reserve currency, the United States gets to exchange printed paper (dollars) for goods and services produced by its trading partners. In the case of the trade deficit, the incoming U.S. dollars balance its international books in the capital account as money flows either into portfolio investments ( e.g. stocks , bonds ) or into long term investment(industrial capital expenditures). The current account deficit will widen should the U.S. dollar appreciate in response to the Fed’s policy of rate increases in 2017 and 2018. At the same time, protectionist policies will harm its trading partners and this will reduce the amount of excess savings that would normally flow to the United States.

Chart 1 US Current Account

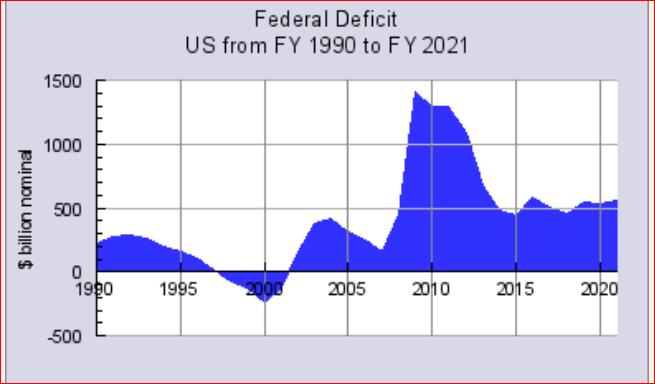

More importantly, the U.S government looks to these strangers to help fund its budget deficit (Chart 2).

The United States has been able to fund its budgetary deficits at low interest rates with the help of foreign governments, sovereign wealth funds and large foreign institutional investors. These entities have been aggressive buyers of U.S. Treasury bonds over the past decade and have played a major role in supporting the Treasury market. Without their support, U.S. long term rates would likely be much higher today.

Leave A Comment