Franco Nevada (FNV) is one of our favorite plays in the precious metal sectors. If you are going to play gold, and do not want to own physical assets or an ETF, we highly recommend a company like Franco Nevada. It is not a miner. Rather, it is a royalty and streaming company, and that gives it a lot of leverage and advantages over traditional companies in the sector.

While there are a number of streaming and royalty companies out there, Franco Nevada is one of the top gold-focused royalty and streaming companies in operation. Relative to its competition, it has the largest and most diversified portfolio of cash-flow producing assets that come from gold operations.

We love the fact that the business model protects downside while leveraging upside. It all comes down to the quality of deals in place. In recent years, they have been hit or miss, but the business model provides investors with gold price and exploration optionality while limiting exposure to many of the risks of operating companies. Keep in mind that Franco-Nevada is debt free and uses its free cash flow to expand its portfolio and pay dividends while generating healthy returns. The stock swings a bit with precious metal prices, but has had a strong few years:

Source: Yahoo finance

Key Portfolio Dynamics

In this column, we actually are going to dig a bit into the portfolio of projects the company has and discuss what progress is being made. This is of particular interest to us because we have a long position in the name. We believe the outlook is quite strong for its portfolio of streams and royalties. It is a global company:

Source: Franco Nevada Asset Map

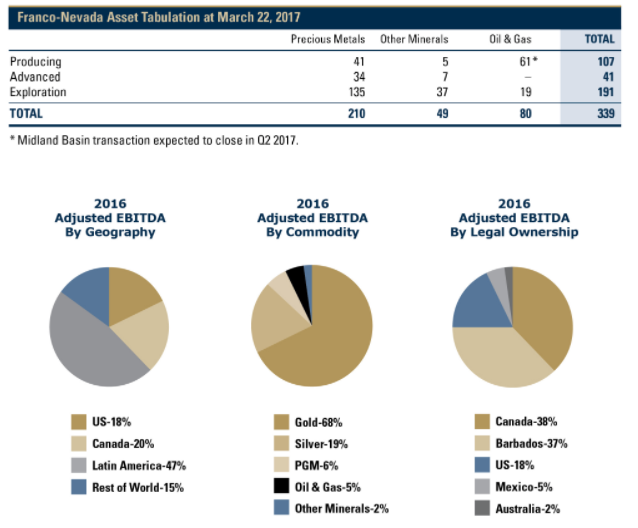

As you can see it has a number of different projects all across the globe. Take a look at the property listings for precious metals, and then for other minerals as well as oil and gas:

Source: Franco Nevada project listing

As you can see, there are a significant number of different projects happening. Detailing them all is beyond the scope of this article but you can read about them here. That said, it may be helpful to know the breakdown of the projects by area and percentage:

Source: Investor project listing

As you can see here, gold is the primary commodity followed by silver and then platinum group metals. There are 107 producing assets, 41 that are advancing, and a whopping 191 that are exploration stage, setting up nicely for the future. So what do we see happening?

General Outlook

Over the next five years, we assume that the Cobre Panama project will be fully ramped-up. From 2019-2021, we expect to see a decline in revenues from the scheduled fixed ounce payments from Midas/Fire Creek, Karma and Sabodala. These are expected to step down to longer-term royalty payments or stream deliveries.

Franco-Nevada expects its existing portfolio to generate between 565,000 to 595,000 gold equivalent ounces [GEOs] by 2022. Oil & gas revenues at the same $55 per barrel WTI oil price assumption are expected to range between $80 million and $90 million.

Let us now discuss updates that we are seeing at the precious metal, mineral, and oil gas segments.

Latin American Precious Metals

For Latin American precious metals, we did not see a change in assets that was meaningful. from Latin American precious metals assets were consistent year-over-year. Precious metal GEOs earned from Latin America were 60,568 GEOs compared with 60,808 GEOs in Q4 2016. Let us talk more specifically about key projects and the attributable production we saw.

Leave A Comment