The “financial weapons of mass destruction ” as Warren Buffett has been calling derivatives since 2002, are harmless and mostly beneficial most of the time – like bacteria. But when something upsets the natural, stable balance they thrive in, we can all get very, very sick. If you have ever bought a simple call option, you have dabbled in derivatives. Sometimes, these things work out and deliver an exciting homerun, but 80% or more of these contracts, which have deadlines, expire worthless. So “fun but dangerous” is the name of the game.

Having said that, derivatives have always been used like insurance policies with periodic premiums (worthless expirations) happily being paid by producers of all manner of crops and mined goods that have surprise price fluctuations. They purchase this insurance to hedge any unexpected price movement whilst they are busy getting their goods sold. So why does a smart guy like Buffett call them weapons of mass destruction?

I think a comment on an article from ABC “$710 Trillion: That’s A Lot Of Exposure To Derivatives” explains the problem well:

…the problem is that too many people can take out derivatives beyond the real needs of the market. For example, imagine I can insure my $100,000 house against fire by paying a fee of $500. Imagine also that 199 other people take out the same fire insurance on MY property, perhaps even using borrowed money to do so. This is the current state of much derivatives activity. If the house burns down the insurance company is up for $20 million. They might well go broke since it is the same to them as having to pay out on 200 property fires. If they did go broke I might not even get my claim paid, yet the other claimants have no underlying real interest in the property or the fire. They have simply made a $500 bet with a $100,000 possible outcome and have done so on borrowed money. The liability should lie with me and my insurance company. So why should the government agree to bail out the 199?

It is simply way too many people playing with derivatives, not as sensible insurance, but for a fast buck. They are not producers. They are not owners. They are just players. I won’t go into the massive scale of the problem, that is beyond the scope of this article, but if you are not aware, you should read up on this, in case you don’t have enough things to worry about.

What I want to focus on here is banks. That is because the 4 or 5 mega US banks are exposed to about 90 – 95% of the total derivatives for the whole country. And this is typical globally. It is not mainly farmers hedging their crops or producers of anything buying insurance. It is financiers playing with OPM (Other Peoples’ Money) in out-of-control complication not protecting crops or insuring anything but their own investments. Thus a staggering 80% of all derivatives are gambles are on interest rates. When you have the Fed announcing 4 rate increases this year, the rest of the world charging into negative rate territory, and the US economy in a manufacturing recession, it is a little worrisome that our banks are riverboat gambling over the next twitch in rates.

More than oil, China, recession, Greece, or any one thing, banking derivative abuse could be our number one problem. It is the one thing that ties all the other problems together and gives them an amplification device. And I would like to show how it may be what’s driving gold right now.

The conventional wisdom for explaining what gold is doing is to attach it do all the things it’s supposed to be dependent on. You know – it has to be doing the opposite of the USD, or be doing whatever commodities are doing, or opposite the broad stock market. Well, don’t look now but it’s not doing any of those things very well over the last several months! Let’s not try too hard to figure out what gold should be doing and just look at the market’s message on what gold is doing.

Gold is breaking its historical correlation with the commodity complex. If you look at the CRB/gold pair, you see that in 2016, gold is sharply breaking away from commodities, and actually began doing this in late 2014. Oil and gold are moving sharply in opposite directions. The gold miners, whose biggest cost is energy, may soon have a field day.

Gold began latching itself to something else in late 2014. Note the sharp, opposite move by gold up as the stunning drop in commodities got a little crazy. Gold then resisted rejoining the CRB, building even more divergence until late 2015, where it is again bolting sharply in the opposite direction. Gold is not just another commodity anymore. So is gold just doing the opposite of the dollar now?

It’s not a very good correlation either. Note that in the sharp, late 2014 commodities swoon, the dollar followed commodities, but gold clearly started to follow something else. Then gold and the USD started to dance together for awhile, as is their custom – until late 2015. Here gold is bolting away from both commodities and the inverse dollar.

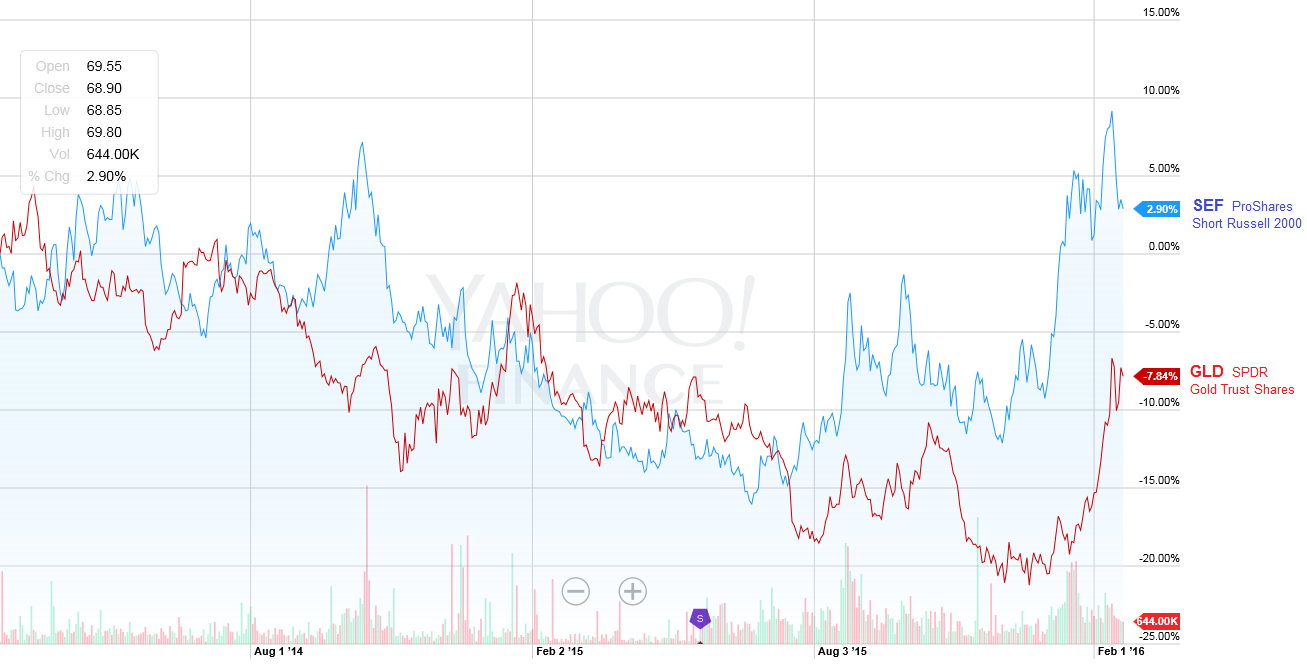

So is gold just being inverse to the broad stock market? Let’s take a good measure of that with the 2000 stocks of the Russell:

Here we have a little better correlation, especially in the last two months. So gold seems to be responding to something that’s now vexing the stock market in general. Let’s see if we can narrow that down to something more specific:

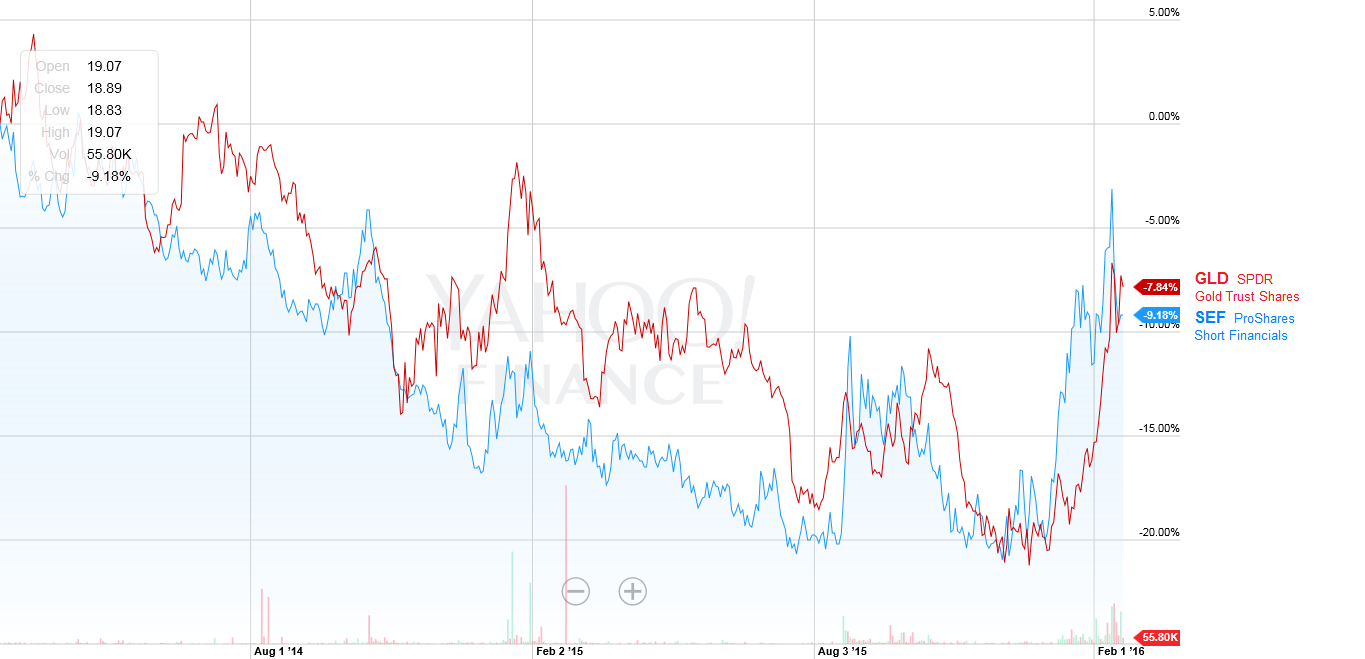

In horseshoes, we call this a “leaner”, the next best thing to a dead ringer. Here we see that gold has been strongly correlating to the inverse of the financials. It’s the banks that gold seems to be mainly concerned with, not the usual stuff. If you look over the charts of the biggest banks of Europe, you may be shocked to find that they nearly all went into a very bad technical breakdown starting clear back in early/mid 2014 as commodities were swooning and their debt and derivative books were taking a beating. By late 2014, gold may have taken note, because it was then where gold sharply broke away from the commodity complex as shown in our first chart above. Now we are seeing the bank stocks being decimated and gold responding in kind. By virtue of commodities being the flavor of the era in the malinvestment cycle, gold has ironically become the anti-commodity.

Leave A Comment